Things You Can Write Off As A Sole Proprietor

You can also deduct annual dues or fees to keep your membership in a trade or commercial association as well as subscriptions to publications. Better still you can take this deduction even if you dont itemize deductions on your tax return.

Top 7 Tax Tips You Must Know If You Are Self Employed Business Tax Deductions Sole Proprietorship Business Tax

Top 7 Tax Tips You Must Know If You Are Self Employed Business Tax Deductions Sole Proprietorship Business Tax

The Canada Revenue Agency allows sole proprietors to claim what the agency terms reasonable business expenses as tax deductions.

Things you can write off as a sole proprietor. Essentially a business expense is ordinary if its of the type that other businesses commonly incur. LLCs that manufacture or resell products can use the cost of goods sold to reduce their tax obligations. This can include things like.

Health insurance deduction One of the main tax advantages of running a sole proprietorship is that you can deduct the cost of health insurance for yourself your spouse and any dependents. The Expenses section of. Expenses Sole Proprietorship Companies Can Write Off 1.

The Schedule C is the principal form that sole proprietors use to separately report net profit or loss computed as gross revenue minus all business expenses you report. That would be Schedule C for a sole proprietor K-1 for a partnership or S corporation or Form. You can deduct any annual licence fees and some business taxes you incur to run your business.

DO deduct for a designated home office if you dont also have another office you frequent. Businesses usually deduct the cost of goods sold by adding up the total cost of goods sold for the year and deducting it from gross receipts. Hiring someone to design a business logo The cost of printing business cards or brochures Purchasing ad space in print or online media Sending cards to clients Launching a new website Running a social media marketing campaign Sponsoring an event.

Thus costs incurred in the typical day-to-day operation of a sole proprietorship are generally tax deductible as. To be allowable each expense must satisfy an ordinary and necessary requirement. Banking and Insurance Fees.

DO deduct business-related banking fees and insurance premiums such as your business. Cost of goods sold. As a sole proprietor you only pay income tax on your net profit which is equal to total earnings less all allowable deductions for business expenses.

Meals and entertainment as long as its directly related to the conduct of your business Moving expenses if you had to move because of your job Music stereo equipment if you play soft background music to help employees be productive andor to make a creative comfortable work environment Office supplies. If you choose to take the first-year deduction it needs to be reported on your business tax form. When youre self-employed you can write off a portion of your personal cellphone and home internet bill.

The deduction is based on how much you use your phone or internet for business use versus personal use. As a sole proprietor you can deduct most of your regular business expenses by filling out a Schedule C Profit Or Loss From Business and turning that over to.

Clickfunnels 404 Error Small Business Tips Small Business Ideas Small Business Start Up

Clickfunnels 404 Error Small Business Tips Small Business Ideas Small Business Start Up

Easy Steps To Start A Homebased Business Home Based Business Sole Proprietorship Business

Easy Steps To Start A Homebased Business Home Based Business Sole Proprietorship Business

22 How To Investing Money Portfilo Ideas In 2020 Business Tax Deductions Business Tax Small Business Tax Deductions

22 How To Investing Money Portfilo Ideas In 2020 Business Tax Deductions Business Tax Small Business Tax Deductions

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Small Business Bookkeeping Business Tax Deductions

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Small Business Bookkeeping Business Tax Deductions

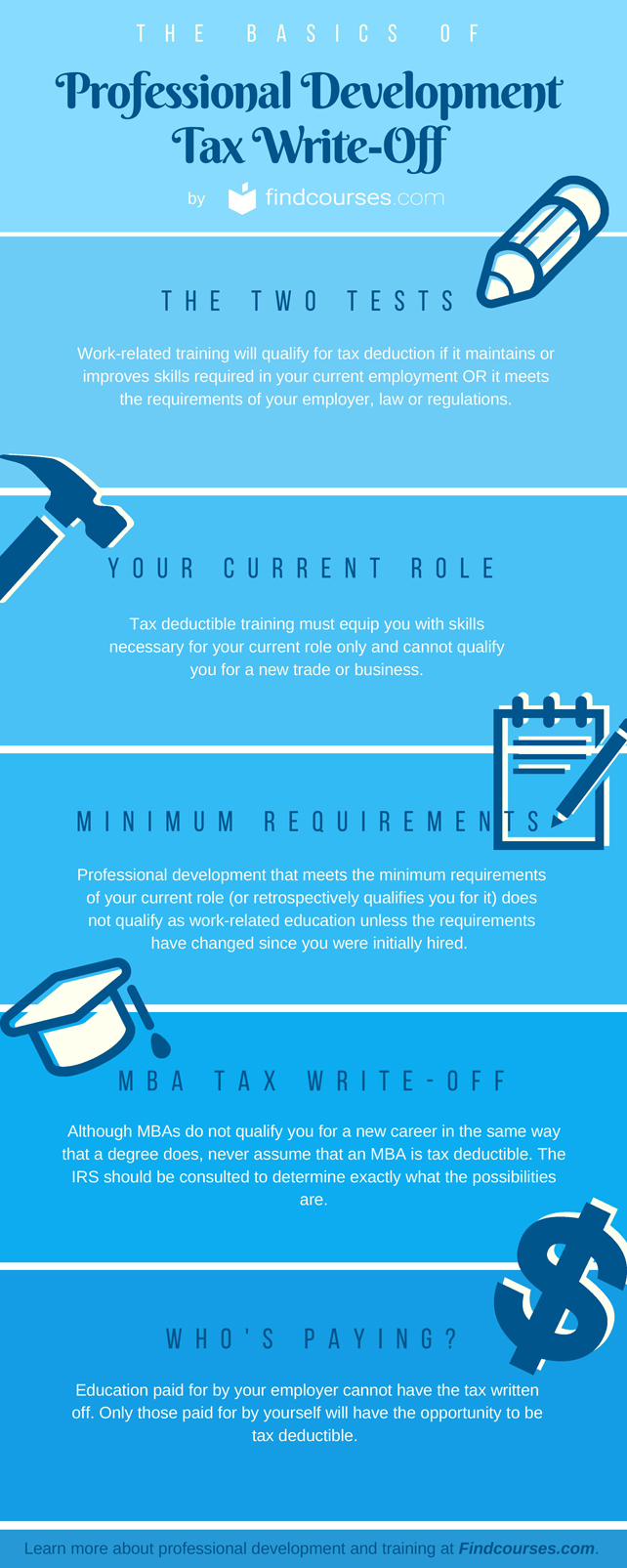

The Professional Development Tax Deduction What You Need To Know

The Professional Development Tax Deduction What You Need To Know

As Business Owners We All Have One Thing In Common Taxes See The 10 Tax Deductions To Take Advan Tax Write Offs Learn Accounting Small Business Bookkeeping

As Business Owners We All Have One Thing In Common Taxes See The 10 Tax Deductions To Take Advan Tax Write Offs Learn Accounting Small Business Bookkeeping

Write Off That Weekend Getaway How To Turn Trips Into Tax Deductions Tax Deductions Traveling By Yourself Tax Write Offs

Write Off That Weekend Getaway How To Turn Trips Into Tax Deductions Tax Deductions Traveling By Yourself Tax Write Offs

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Investment Business Structure

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Investment Business Structure

Choose A Business Structure From Sole Proprietorships To S Corporations There Are Many Forms Of Business Business Structure Sole Proprietorship Business Tax

Choose A Business Structure From Sole Proprietorships To S Corporations There Are Many Forms Of Business Business Structure Sole Proprietorship Business Tax

Is Any Loan Interest Tax Deductible Yes These Interests Are Deductible Some Fully Some Par Small Business Tax Deductions Business Tax Deductions Business Tax

Is Any Loan Interest Tax Deductible Yes These Interests Are Deductible Some Fully Some Par Small Business Tax Deductions Business Tax Deductions Business Tax

This Is Great For Any Small Business Owner Who Is Looking To Maximize Their Tax Write Offs Tax Write Offs Small Business Tax Deductions Business Tax Deductions

This Is Great For Any Small Business Owner Who Is Looking To Maximize Their Tax Write Offs Tax Write Offs Small Business Tax Deductions Business Tax Deductions

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Gross Income Net Income Small Business Finance Accounting Small Business Finance Small Business Bookkeeping Business Checklist

Gross Income Net Income Small Business Finance Accounting Small Business Finance Small Business Bookkeeping Business Checklist

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Does Tax Season Make You Cringe As An Entrepreneur Learn How To Save Hundreds In Business Write Offs Tax Write Offs Business Tax Deductions Business Writing

Does Tax Season Make You Cringe As An Entrepreneur Learn How To Save Hundreds In Business Write Offs Tax Write Offs Business Tax Deductions Business Writing

How To File Your Llc Tax Return Llc Taxes Small Business Tax Deductions Business Tax Deductions

How To File Your Llc Tax Return Llc Taxes Small Business Tax Deductions Business Tax Deductions

Sole Proprietorship Startup Tips For Your New Business Including Vs Llc Taxes Advantag Sole Proprietorship Writing A Business Plan Small Business Accounting

Sole Proprietorship Startup Tips For Your New Business Including Vs Llc Taxes Advantag Sole Proprietorship Writing A Business Plan Small Business Accounting

5 Write Off Mistakes That Can Get You In Trouble Small Business Tax Small Business Accounting Business Tax

5 Write Off Mistakes That Can Get You In Trouble Small Business Tax Small Business Accounting Business Tax