Ordinary Business Income Form 1120s

For year-end corporations the due date is 15 th April 2021. I noticed that on my personal income tax return using TurboTax entering the 1120S Schedule K-1 Box 16D amount reduces my Qualified Business Income deduction dropping my QBI a lot lower than S-Corp ordinary business income x 20.

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

For 2020 a corporation that a is required to file Schedule M-3 Form 1120-S Net Income Loss Reconciliation for S Corporations With Total Assets of 10 Million or More and has less than 50 million total assets at the end of the tax year or b isnt required to file Schedule M-3 Form 1120-S and voluntarily files Schedule M-3 Form 1120-S must either complete Schedule M-3 Form 1120-S entirely or complete Schedule M-3.

Ordinary business income form 1120s. Adjustments Increasing Ordinary Business Income. Income Tax Return for an S Corporation Form For calendar year 2008 or tax year beginning 2008 ending 20 Department of the Treasury Internal Revenue Service See separate instructions. That flows nicely to the M-1 which now has line 1 correct as the Net income loss per books and the correct taxable income on line 8.

Ordinary business income is shown in box 1 of Schedule K-1 Form 1120S. Totals Adjustments Decreasing Ordinary Business Income. To enter the income items from a K-1 Form 1120S in TaxSlayer Pro from the Main Menu of the Tax Return Form 1040 select.

Go to Form 1120S p3-5 and enter the EIDL grant money on Schedule K line 16b directly or via the M-1 worksheet as suggested by TT right on the form above line 16b. Nebraska Schedule A Adjustments to Ordinary Business Income. S election effective date A Name DEmployer identification number Use IRS label.

Essentially Form 1120-S is an S. Tax return Series Form 1120 with K1 1120S Corporation Line 21 Ordinary Income _____ K1 Line 1 Ordinary Income _____ Schedule E Part II Net Income _____ 1040 Line 17 Net Income SchE _____ Taxed at a personal rate H 16. If the initial K-1 entry was previously keyed in double click on the entry in the K-1.

Is there a reason for that. If you are filing as a C Corporation file form 1120. This deduction is commonly referred to as the Qualified Business Income Deduction QBID and it was enacted as part of the Tax Cuts and Jobs Act TCJA.

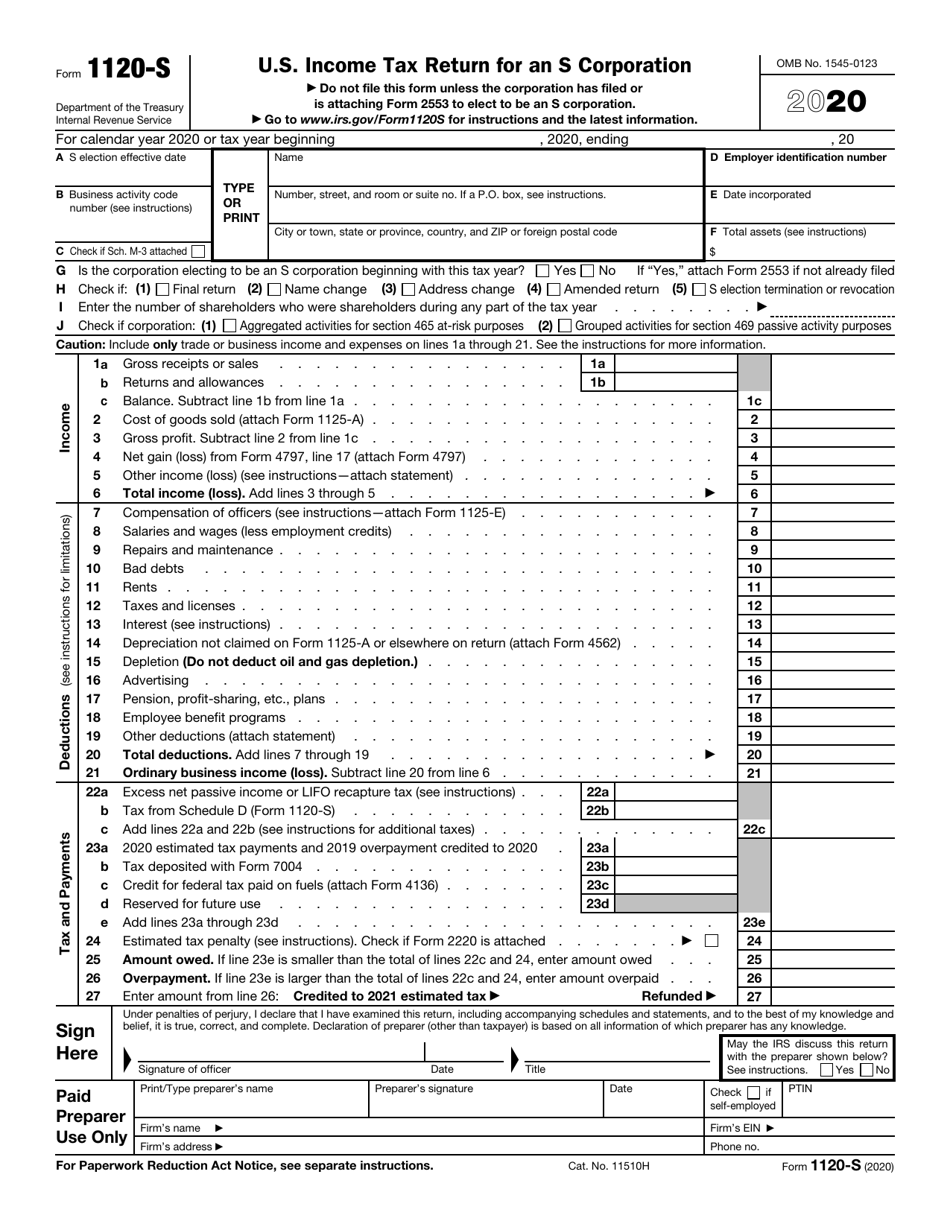

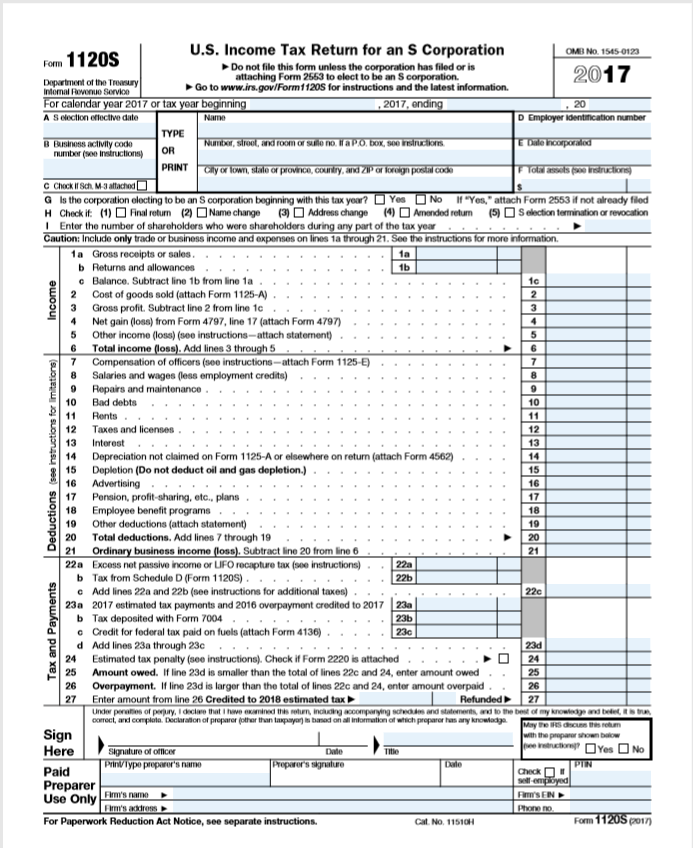

Go to wwwirsgovForm1120S for instructions and. Form 1120S is US. The corporation is liable for taxes on lines 22a 22b and 22c on page 1 of Form 1120S.

Ordinary Business Income Loss The amount reported in box 1 is your share of the ordinary income loss from trade or business activities of the corporation. Name on Form 1120-SN Nebraska ID Number. Tax due dates for various Business types in 2021.

Does ordinary business income from Schedule K-1 qualify as earned income for purposes of IRA contribution deductability. Rents Royalties Entities Sch E K-1 4835 8582 K-1 Input - Select New and double-click on Form 1120-S K-1 S Corporation which will take you to the K-1 Heading Information Entry screen. If the ordinary income for a S Corporation form 1120S line 21 indicates a profit of 20000000 for the year but the shareholders wish to only report 10000000 to their K-1s for the year how is the other 10000000 reported as.

S Corporation With Other Income And Deductions. The 1120S is only for S Corps. As a pass-through entity the income or loss from a Subchapter S-Corporation Form 1120S is treated on the tax return of its owner s as Qualified Business Income or Loss under the Section 199A deduction.

Shareholders must include their share of the income on their tax return whether or not it is distributed to them. Either way seems to be fine. Partnership tax returns on IRS Form 1065 along with the.

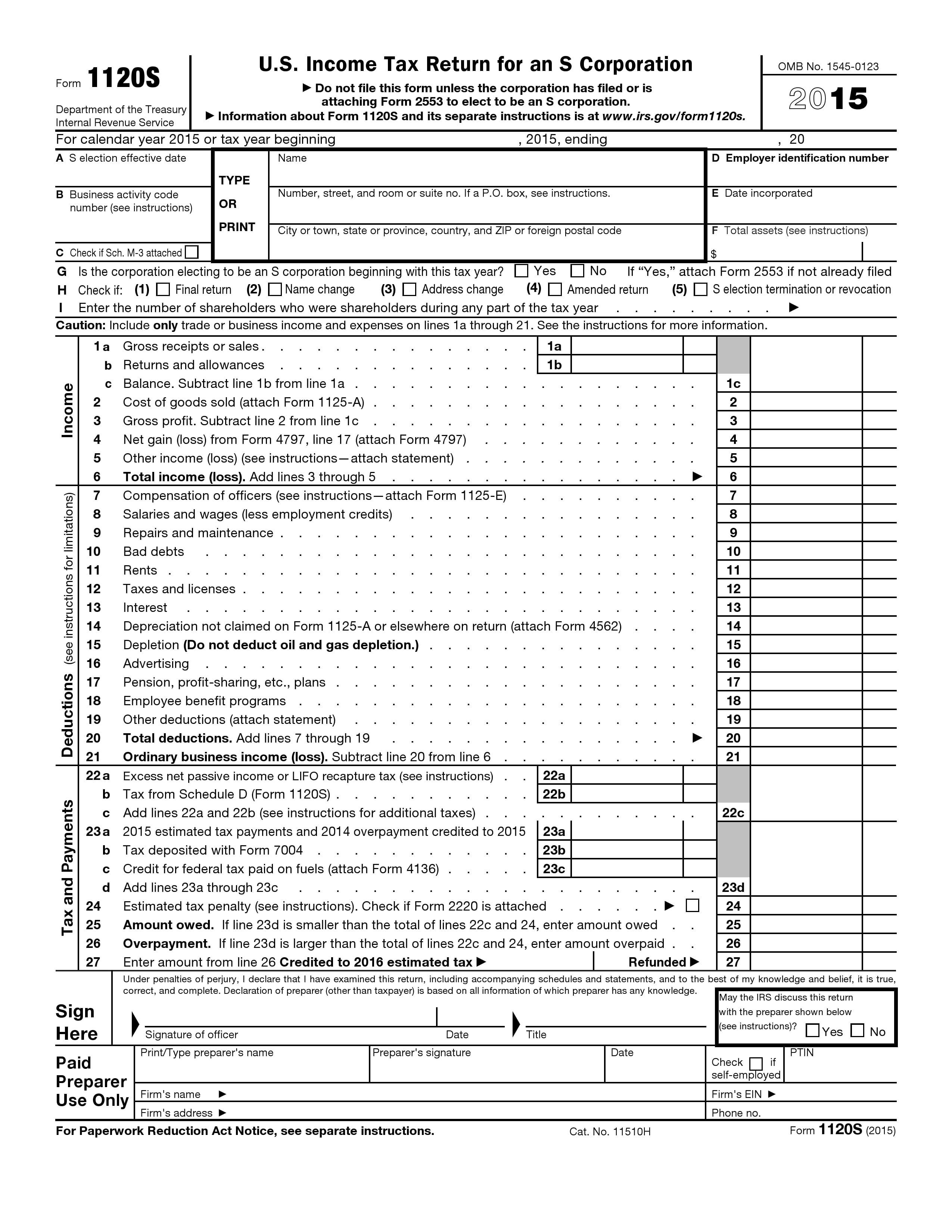

Income Tax Return for an S Corporation Department of the Treasury Internal Revenue Service Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. Other-wise print or type. Enter amounts for lines 1 through 4 from Schedule K Federal Form 1120S.

Income Tax Return for an S Corporation is a tax document that is used to report the income losses and dividends of S corporation shareholders. Less returnsallowances with net gainloss from Form 4797 Sales of. First total income is calculated in the Income Section of page 1.

Number street and room or suite no. S-corporation tax returns on IRS Form 1120- S15 th March 2021. Shareholders are liable for tax on their shares of the corporations income reduced by any taxes paid by the corporation on income.

Its literally one page 8 lines and will take about 30 seconds. My distribution is an income distribution. This tax form is due to be postmarked by March 15th but you can file an extension on Form 7004.

I was told by the CPA firm that prepared the 1120 S that ordinary business income on line 1 of K-1 is subject to ss taxes. Income Tax Return for an S Corporation. Generally where you report this amount on Form 1040 or 1040-SR depends on whether the.

C-corporation tax returns on IRS Form 1120. Form 1120-S 2020 US.

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

What Is Form 1120s And How Do I File It Ask Gusto

What Is Form 1120s And How Do I File It Ask Gusto

Irs Form 1120 S Download Fillable Pdf Or Fill Online U S Income Tax Return For An S Corporation 2020 Templateroller

Irs Form 1120 S Download Fillable Pdf Or Fill Online U S Income Tax Return For An S Corporation 2020 Templateroller

Fill Out The 1120s Form Including The M 1 M 2 Wi Chegg Com

Fill Out The 1120s Form Including The M 1 M 2 Wi Chegg Com

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Form 1120s S Corporation Tax Return Fill Out Online Pdf Formswift

Form 1120s S Corporation Tax Return Fill Out Online Pdf Formswift

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Free U S Income Tax Return For An S Corporation Form 1120s Pdf Template Form Download

Free U S Income Tax Return For An S Corporation Form 1120s Pdf Template Form Download

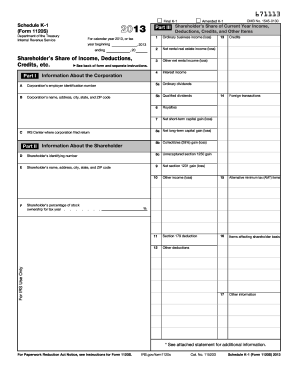

2013 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2013 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

What Is Form 1120s And How Do I File It Ask Gusto

What Is Form 1120s And How Do I File It Ask Gusto

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Premiuminc Form 1120s U S Income Tax Return For An S Corporation Omb No 1545 0123 Do Not File This Form Unless The Corporation Has Filed Or Is Course Hero

Premiuminc Form 1120s U S Income Tax Return For An S Corporation Omb No 1545 0123 Do Not File This Form Unless The Corporation Has Filed Or Is Course Hero

Draft 2019 Form 1120 S Instructions Adds New K 1 Statements For 199a Current Federal Tax Developments

Draft 2019 Form 1120 S Instructions Adds New K 1 Statements For 199a Current Federal Tax Developments