How To Apply For 40k Small Business Loan

Business owners can apply for support until June 30. When you are ready to close complete all closing items required and receive funding.

Covid 19 Business Banking Resources And Support Regions

Covid 19 Business Banking Resources And Support Regions

Banks open up applications for 40000 interest-free emergency business loans.

How to apply for 40k small business loan. Applicants can check the status of their CEBA Loan online at httpsstatus-statutceba-cuecca. Hopefully this is a sign that your business is healthy and growing. Pick your business location.

Plan your business. Review terms and conditions including any down payment requirements fees and time to close. In the Balance field enter the amount in the account and determine the as of date.

The EIDL application asks for your gross revenue for the 12 months prior to Jan. Applicants Seeking Status Updates. Since the future payments to the bank are a liability for your.

Give the account a relevant name like Loan for a car Choose when you want to start tracking your finances. The CEBA provides interest-free loans up to 60000 to eligible small businesses. Apply for licenses and permits.

Canadian banks have begun enrolment for the Canada Emergency Business Account which is meant to provide interest-free loans of up to 40000 to small businesses and not-for-profits to help cover operating costs for businesses. The SBA estimates that it will take you two hours and 10 minutes to apply. Be sure to check out other loan options from the Small Business Administration SBA other federal loan programs and organizations and.

To qualify under the expanded eligibility criteria applicants with payroll lower than 20000 are required to have a business operating account at a participating financial institution. Write your business plan. The interest rate for PPP loans are 1.

These loans are offered at a 375 percent interest rate for small businesses and a 275 percent interest rate for nonprofit organizations. Applicants who have received the previous 40000 CEBA loan may apply for an additional 20000 in financing. 31 2020 for example.

Be prepared to show your operating expenses. You should know however is that applying for a small business loan is nothing like applying for a student loan or an auto loanIn fact the process shares more in common with applying to college or a job or even dating. Use Lender Match to find lenders that offer loans for your business.

Repaying the loan on or before December 31 2022 results in a loan forgiveness amount of up to 20000. As of December 4 2020 hard-hit small businesses and not-for-profits could be eligible for an additional 20000 CEBA loan on top of the 40000 already available. To include all business owners on the application with at least 20 ownership Business and personal information including Tax ID number and estimated gross annual sales Online application is limited to businesses with no more than two owners.

Submit the app to get small business loan options for your business during the coronavirus covid-19 pandemic. Market research and competitive analysis. A Canada Revenue Agency business number and to have filed a 2018 or 2019 tax return.

Further 25 of this up to 10000 will be forgiven if the loan is repaid by December 31 2022. Small business owners can apply for a larger EIDL loan but the first 10000 is a grant that does not need to be paid back. Any business with fewer than 500 employees can apply for a first-time loan and any business that already received a PPP loan.

On Thursday April 9 banks officially opened up applications for the 40000 interest-free loan program introduced by the federal government as a way to support small businesses. Choose your business name. Buy an existing business or franchise.

Economic Injury Disaster Loan EIDL Emergency Advance. Enter todays date if you want to start tracking immediately. In order to apply and qualify online youll need.

And eligible non-deferrable expenses such as rent property taxes utilities and insurance between 40000 and. Thinking of applying for a small business loan. You can apply for an EIDL through the SBA website.

Theres plenty of research and patience. When you are approved request closing documents. Enter the full loan amount as a negative amount in the Amount field.

Coronavirus Small Business Loan Application Process Heres how small businesses can apply for an EIDL. Businesses and non-profits can qualify to receive an interest-free loan of up to 40000 if their revenues have been reduced due to COVID-19. Top Rated Providers We only represent transparent top rated and quick-turnaround providers who have already delivered over 10 billion to businesses like yours.

The SBA has announced that businesses affected by the COVID-19 pandemic will now be eligible to apply for these loans through Dec. There is no specific criteria on how much your revenues have to decrease to qualify for this program. Choose a business structure.

Once the 14 days end the original eligibility criteria will resume. Those affected can describe their losses Eligible small businesses must complete an Economic Injury Worksheets detailing the economic losses they have suffered due to the coronavirus. If your small business is losing revenue due to the COVID-19 pandemic you may be eligible for up to 10000 in emergency economic relief.

Get federal and state tax ID numbers. This means the additional loan effectively increases CEBA loans from the existing 40000 to 60000 for eligible businesses of which a total of 20000 will be forgiven if the balance of the loan is repaid by December 31 2022. Although the PPP has been the most popular loan program for small businesses it may not be the right solution for every business.

Specializing in small business loans Anacortes WA we work to get you money while you remain focused on your business. Start or expand your business with loans guaranteed by the Small Business Administration.

Consolidate Your Debt Sign Up To See If You Qualify For A Personal Loan If You Re A User Experience Professional List Personal Loans Finance Debt Budgeting

Consolidate Your Debt Sign Up To See If You Qualify For A Personal Loan If You Re A User Experience Professional List Personal Loans Finance Debt Budgeting

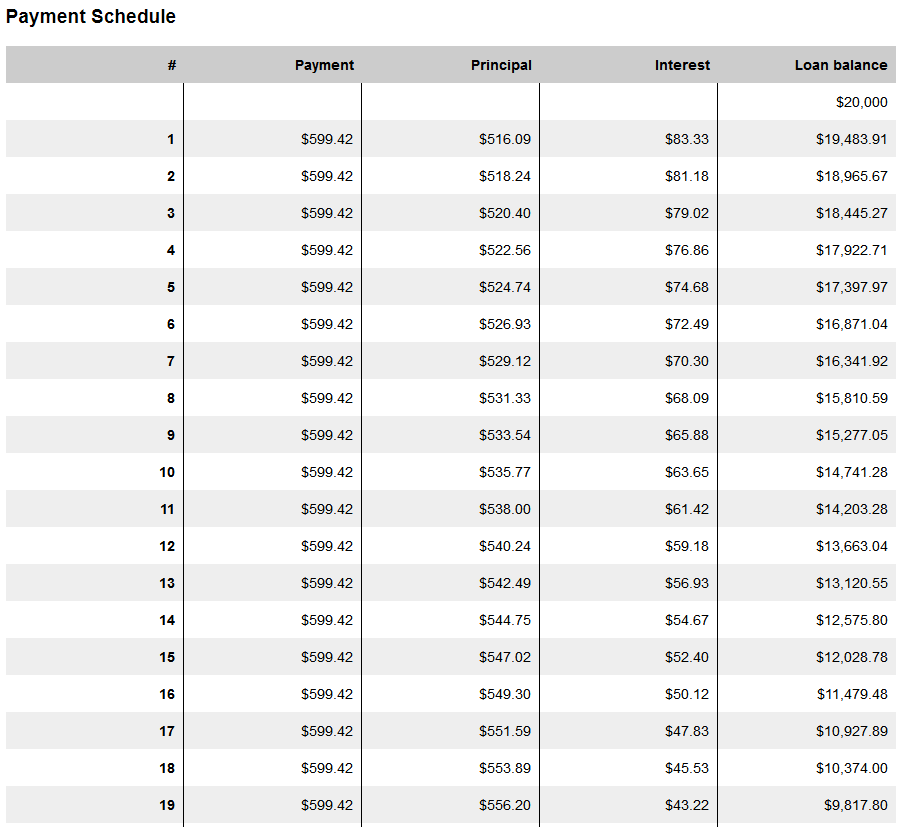

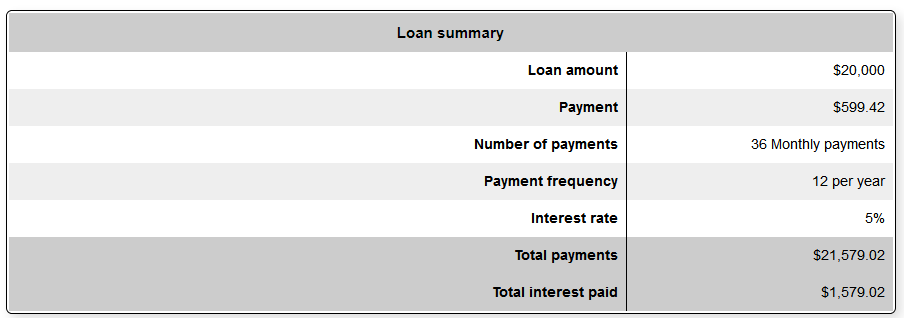

Loan Amortization Comparison Mortgage Amortization Amortization Schedule Refinance Loans

Loan Amortization Comparison Mortgage Amortization Amortization Schedule Refinance Loans

7 Epic Ways I Knocked Out 40k In Credit Card Debt Quickly Credit Cards Debt Small Business Credit Cards Debt

7 Epic Ways I Knocked Out 40k In Credit Card Debt Quickly Credit Cards Debt Small Business Credit Cards Debt

The Easy Way To Start A Small Business From Home Follow Me To Get Free Marketing Tips Here Email Marketing Business Online Marketing Small Business From Home

The Easy Way To Start A Small Business From Home Follow Me To Get Free Marketing Tips Here Email Marketing Business Online Marketing Small Business From Home

How To Fill Out The Sba Disaster Loan Application Youtube

How To Fill Out The Sba Disaster Loan Application Youtube

Loan Programs The U S Small Business Administration Sba Gov

Loan Programs The U S Small Business Administration Sba Gov

Get Rid Of All The Bills At Once Apply Personal Loan Online Through Myfundbucket Visit Www Myfundbucket Com Person Personal Loans Personal Loans Online Loan

Get Rid Of All The Bills At Once Apply Personal Loan Online Through Myfundbucket Visit Www Myfundbucket Com Person Personal Loans Personal Loans Online Loan

Mortgage Loan Types Infographic To Learn More About Mortgages Visit Http Todaysmortgage N Mortgage Loans Mortgage Loan Calculator Mortgage Loan Originator

Mortgage Loan Types Infographic To Learn More About Mortgages Visit Http Todaysmortgage N Mortgage Loans Mortgage Loan Calculator Mortgage Loan Originator

These 5 Grants Were Created Specifically To Help Women Start Businesses Business Grants Starting A Business Small Business Start Up

These 5 Grants Were Created Specifically To Help Women Start Businesses Business Grants Starting A Business Small Business Start Up

Why You Should Start A Resume Writing Business Writing Jobs Small Business Opportunities Resume Writing

Why You Should Start A Resume Writing Business Writing Jobs Small Business Opportunities Resume Writing

Easy Sba Paycheck Protection Program Ppp Loan Calculator Lendio

Easy Sba Paycheck Protection Program Ppp Loan Calculator Lendio

From 40k In Student Loan Debt To Running A 7 Figure Online Biz And Traveling Full Time Student Loan Debt Student Loans Online Biz

From 40k In Student Loan Debt To Running A 7 Figure Online Biz And Traveling Full Time Student Loan Debt Student Loans Online Biz

Https Www Weyerhaeuser Com Download File 4292 0

Venue Business Plan Template The Lindsay Lucas Business Plan Template Event Venue Business How To Plan

Venue Business Plan Template The Lindsay Lucas Business Plan Template Event Venue Business How To Plan

Sba Eidl Loan For Small Business Application Up To 150k Youtube

Sba Eidl Loan For Small Business Application Up To 150k Youtube

6 Small Business Grants For Women One Pays Up To 40k Business Grants Small Business Management Scholarships For College

6 Small Business Grants For Women One Pays Up To 40k Business Grants Small Business Management Scholarships For College

Lending Club Targets Potential Client Investors With A Cross Promotion With United Mileageplus The Landing Page M Investing Landing Page Landing Page Examples

Lending Club Targets Potential Client Investors With A Cross Promotion With United Mileageplus The Landing Page M Investing Landing Page Landing Page Examples