Can I Print My Own 1099

Select 1099 Wizard click Get Started. Select all vendors you wish to print 1099s for.

Print and file copy A downloaded from this website.

Can i print my own 1099. Click on the link for 1099-MISC form. You can certainly use the Adobe pdf blank 1099-MISC form available from the IRSgov website to print Form 1099-MISC and give copies B C to your independent contractors as well as others to whom you need to legally issue 1099s such as attorneys etc. My name is I am an Enrolled Agent credentialed by the IRS.

Pre-printed 1099-NEC kits are compatible with QuickBooks Online QuickBooks Online Payroll QuickBooks Desktop 2020 or later and QuickBooks for Mac 2020 or later. You can get it with the printing software for about. Read any warnings that appear for the particular Form 1099 you wish to print.

Click print at the bottom of the window to send the document to your printer. You will need to have a dedicated check writing printer or change toner every time that you print checks. Printable from laser and inkjet printers.

The short answer is yes you can fill out a 1099 by hand but theres a little more to it than that. Select Print 1096s instead if printing. You will not need to print Form 1096.

Was missed in earlier 1099 printing. See part O in the current General Instructions for Certain Information Returns available at wwwirsgovform1099 for more information about penalties. If you are sending a 1099 form you can print one for yourself and your recipient but you must order a free official scannable version to send to the IRS or they may assess a.

Print and file copy A downloaded from this website. Right click on the form and select print. As a freelancer you do not generate your own 1099.

Well not so fast. Your state unemployment office will have your 1099-G. The victim does not need to complete the additional form normally required by.

A penalty may be imposed for filing with the IRS information return forms that cant be scanned. Not all Forms 1099 are printable through the IRS website because not all printed copies may be scanned and 1099s must be scanned to be accepted by the IRS. A penalty may be imposed for filing with the IRS information return forms that cant be scanned.

Select your home printer from the list of printers that appears by clicking on it. You can order physical blank 1099 forms online or from an office supply store. Although you can e-File your federal 1099-NEC e-Filing with the states is currently unavailable.

22 shipped for a kit of 25. Printing checks on blank check stock requires a special magnetic toner which is used on a laser printer. Needs a corrected 1099.

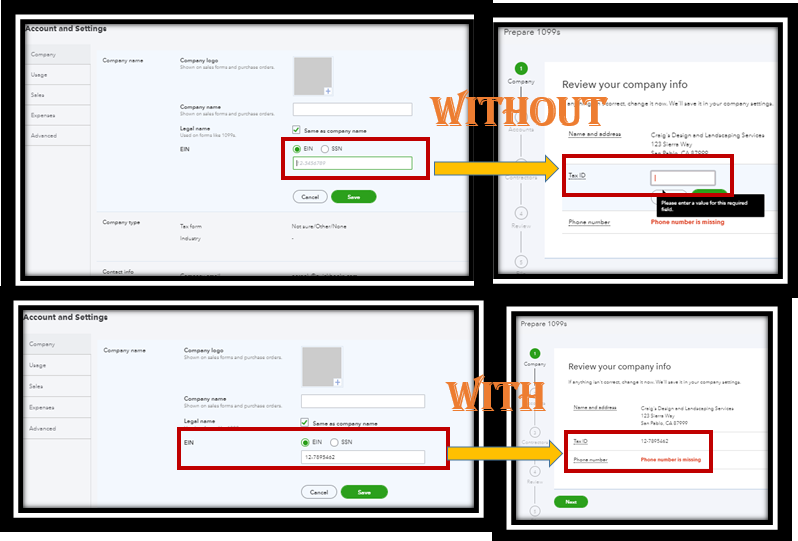

Heres how to print your 1099 form. If you have e-Filed your 1099-MISCs you only need to print your 1099s to give to your contractors. In the Choose a filing method window select the Print 1099-NEC or Print 1099-MISC button.

Instead the company who contracted you furnishes the form in January of the year after you complete the contract. I will be happy to assist you today. The simple answer is yes with a few minor caveats.

See part O in the current General Instructions for Certain Information Returns available at wwwirsgovform1099 for more information about penalties. Select the Print 1099 button. Print paper 1099-NECs to file with your state as well as distribute to contractors.

Handwriting your tax forms comes with a long list of rules from the IRS since handwritten forms need to be scanned by their machines. The victim should not wait for a revised UC-1099 to file hisher taxes. Can i print my own 1099 forms 2019 can you print 1099 forms online can you print out 1099 forms free printable 1099 forms irsgov how can i get 1099 forms online.

You then print it out yourself and mail it. However Form 1099-MISC Copy A which should be kept by you and then filed. Follow the on-screen directions for obtaining copies of Forms 1099 that are not printable.

Specify the date range for the forms then choose OK. Click Vendors choose PrintE-file 1099s. This means that if you contracted with multiple companies and made 600 or more from each company you will receive multiple 1099s one from each company.

In the Verify your vendors information window make sure the data is correct and click Continue. In the Select your 1099 vendors window check off the vendors who. Keep it simple right.

Welcome to Just Answer. Although the IRS will accept handwritten forms they do caution that the writing must be completely legible and accurate in order to avoid errors in processing. Per the IRS the victim can move forward with filing their taxes reporting only their true income and not fraudulent income reported in their name.

Can you handwrite a 1099 or a W2 is one of our most common questions surrounding tax preparation. You might be wondering can I print 1099 on plain paper and whether or not your 1099s W-2s and other tax forms can be handwritten. Just Answer is not associated with your state unemployment office.

State youre filling in.

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

How To Fill Out And Print 1099 Misc Forms

How To Fill Out And Print 1099 Misc Forms

How To Fill Out And Print 1099 Misc Forms

How To Fill Out And Print 1099 Misc Forms

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

How To Fill Out And Print 1099 Misc Forms

How To Fill Out And Print 1099 Misc Forms

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax