What Is A W8 Form Used For In Canada

The primary purpose of such laws was to track transactions between financial institutions and to crack down on suspicious arrangements in the fields of finance insurance government investment etc. Nonresidents must fill out when they earn income from US.

Canadians Stop Paying 30 To The Irs Diana Tibert

Canadians Stop Paying 30 To The Irs Diana Tibert

Sources must fill out the form but they can use it to claim exemption from withholdings due to income tax agreements between the US.

What is a w8 form used for in canada. Sole proprietorship in your own name youll need to complete Form W-8BEN. Income you may receive in your account. To make things more confusing the W-8 series contains five different forms that can be used to manage tax requirements for entities that are claiming foreign tax ID status.

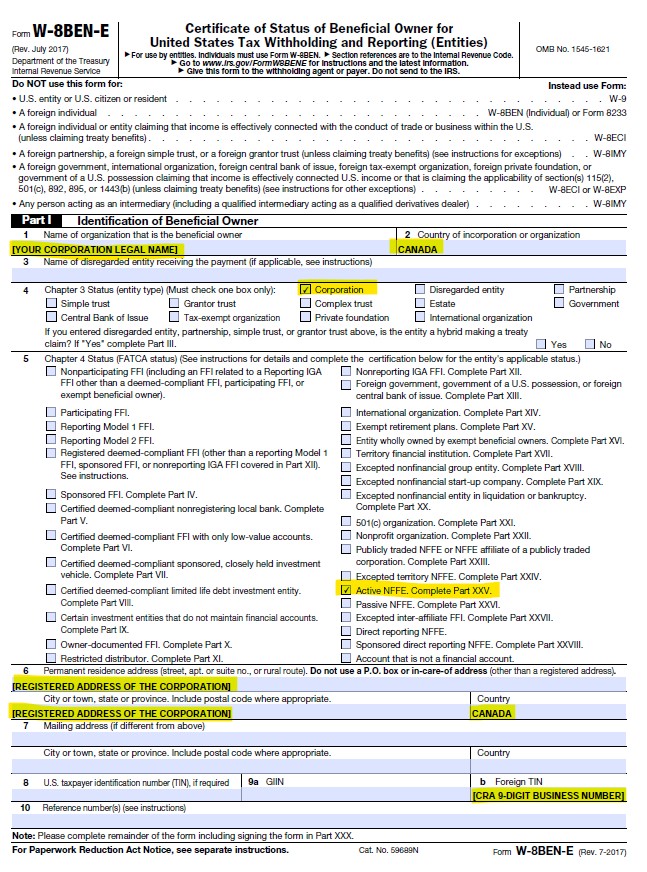

For most active Canadian companies the W8-BEN-E form will be used to determine that no withholding taxes should apply on the money paid to you due to the Canada US tax treaty. This one has a rather long name Certificate of Foreign Persons Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States and is designed for nonresident aliens who conduct a. The form exempts the foreign resident from certain US.

Historically the form was used by US. Whether you complete the form yourself or ask your tax advisor to assist you with completing it dont ignore your clients request for this important form. This covers dividends from US.

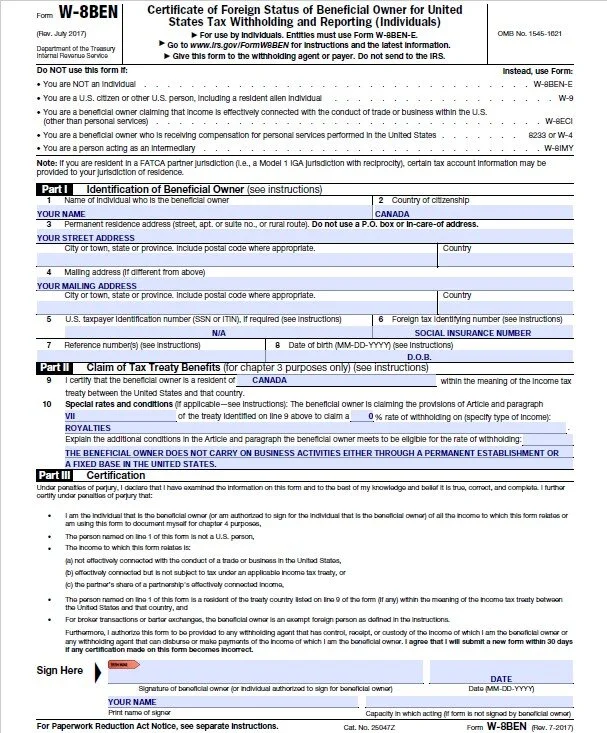

How to complete W-8BEN Form for an individual in Canada. Form W-8BEN is a tax form that US. Or by foreign business entities who make income in the US.

John Smith Canada Canada 1234 Main Street West Toronto ON A1A 1A1 Canada 04-25-2019 PART III. Sources in order to determine their required tax withholdings. W8 forms have been created to rigorously document such transactions.

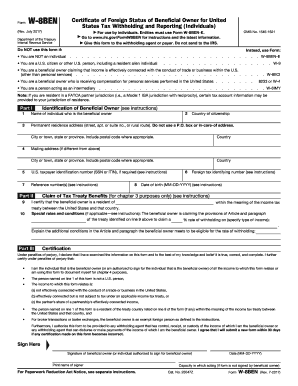

About Form W-8 BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. Completing Form W-8BEN confirms to the IRS that you are not a US. The W-8BEN-E is a form from the United States tax collection agency the Internal Revenue Service IRS.

FATCA requires any foreign company that receives payments from US. Institutions to document an individuals foreign non-US status and to allow the foreign person to claim certain treaty benefits for various US. Resident that you do not work in the US and that you will report your income to the Canada Revenue Agency.

However if youre already paying tax on your income to the Canadian Revenue Agency CRA you can complete the W8-BEN form and give it to your client to confirm that they should release your full payment with nothing withheld. This form contains information such as payee name address and tax identification number. This works because the US and Canada have a tax treaty which is in place to stop double taxation².

W-8 forms are Internal Revenue Service IRS forms that foreign individuals and businesses must file to verify their country of residence for tax purposes and certify that they qualify for a lower. Its purpose is mainly to let brokers. A W-8 form is a tax form that tells organizations and people doing business within the United States that the person they are doing business with is not a US.

If you are a certified resident of Canada a W-8BEN form allows you to make a claim a tax treaty benefit for a reduction on the tax withheld from US. In a nutshell a W 8 form is used by foreign businesses and non-resident aliens earning income from US. Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US.

All foreign non-US businesses that are receiving payment from an American company must fill out the W-8BEN-E form. Each is used under particular circumstances. Sources to complete the new Form W-8BEN-E and submit the form to the American payor who must then withhold a flat 30 of the amount they pay to the foreign company.

In order to determine whether to withhold taxes for the payments they send the withholding agent must obtain a Form W-8BEN from the foreign payee. The W-8BEN-E form is used to prove that the business providing the services is indeed a foreign entity. The W-8BEN form serves several purposes.

Canadian independent contractors earning income from US. If youre a legal citizen of the United States at no point will you have to worry about filling out the form. For individuals ex.

Four different forms fall under the heading of a W-8 form. Certification MANDATORY The form must be signed and dated by the beneficial owner of the income of the account or a person with legal authority to act on the beneficial owners behalf. Sign and date the form.

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

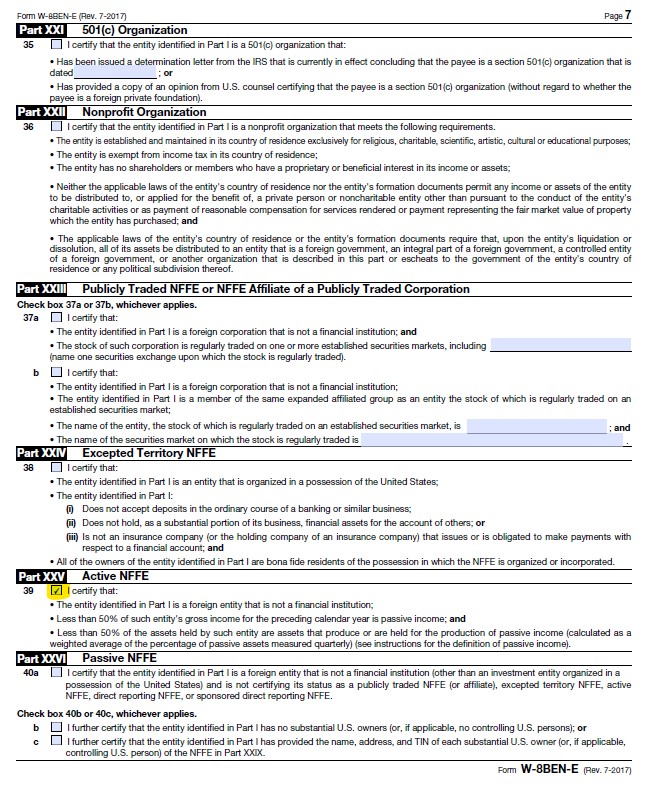

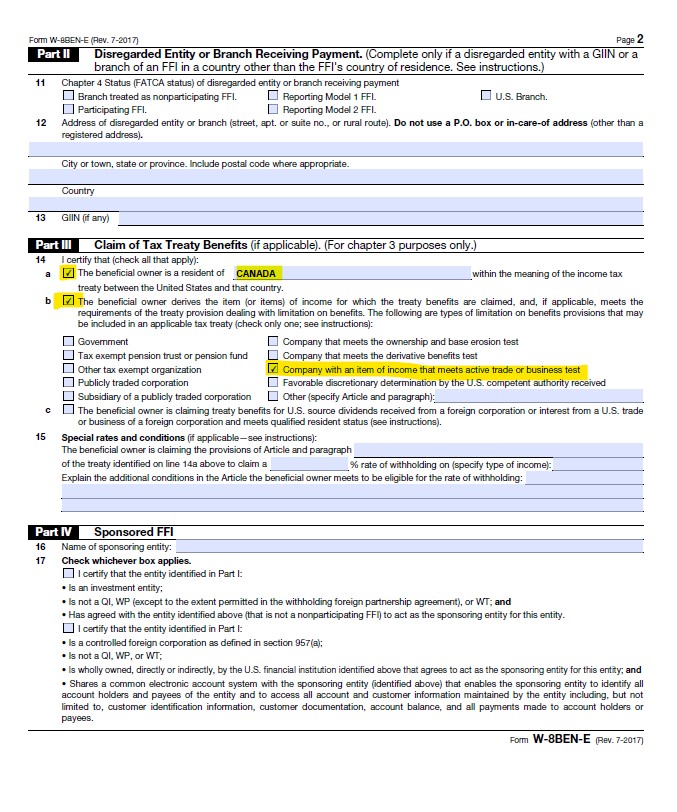

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

Fake Form W 8ben Used In Irs Tax Scams Trendlabs Security Intelligence Blog

What Is A W 8 Form The Dough Roller

What Is A W 8 Form The Dough Roller

Filing Of W 8ben E By Canadian Service Provider With A Sample

Fake Form W 8ben Used In Irs Tax Scams Trendlabs Security Intelligence Blog

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Filing Of W 8ben E By Canadian Service Provider With A Sample

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

W 8ben Fill Out And Sign Printable Pdf Template Signnow

W 8ben Fill Out And Sign Printable Pdf Template Signnow

Why Have I Been Asked To Fill Out A W 8 Ben E Form Virtual Heights Accounting

5 Us Tax Documents Every International Student Should Know

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer