Can You Deregister For Vat At Any Time

This could happen because your business stops trading or you no longer make VAT taxable sales or if you join a VAT group. You can satisfy HMRC that your taxable turnover in the next 12 months will not exceed the VAT registration cancellation limit currently 83000.

Businesses can deregister from VAT in some circumstances.

Can you deregister for vat at any time. You would not have to account for VAT if the value of these assets and stock is 1000 or less. You can deregister as above. Your business can deregister if it expects taxable sales in the next 12 months to be less than the deregistration threshold which stands at 83000 in 201819.

On the following screen click the deregister link to deregister. There is a de-registration threshold which is actually the exception from registration figure which has traditionally tracked the registration threshold at 2k less though there is no obvious reason why it should be this figure. You can ask HMRC for voluntary VAT registration cancellation if any of the following occur.

However as you have indicated you are holding stock worth over 3000 this exemption would not apply. Thus to deregister from VAT MOSS with effect from 1 January 2019 notice must be given by 15 December 2018. The general approach is that once an entitys turnover is below that threshold the entity need no longer be registered until and.

The deregistration process for VAT MOSS must be done online and you must give HMRC at least 15 days notice before the end of the quarter in which notice to deregister from VAT MOSS is given. A voluntary deregistration from VAT can take effect from a current or future date. This process could effectively mean not charging for VAT when for a long time we would actually have been over the threshold just by registering and then deregistering again shortly after saying we anticipate being below the threshold for the next 12 months which starts the 12 month rolling period again and then registering after 12 months if it turns out were over the threshold and shortly after deregistering.

You must cancel your registration if youre no longer eligible to be VAT registered. A vendor will be deregistered only if all outstanding liabilities or obligations incurred under the VAT Act have been settled or resolved. However before you do so you should take professional advice as there are some potential pitfalls.

You join a VAT group. Then when life starts to return to normal you can re-register for VAT. For more information about any aspect of VAT.

You may have to account for VAT on the value of certain business assets and stock on hand at the time of deregistration. Note that it is not always in the interest of a business to remain VAT registered and there may be circumstances in which deregistering for VAT might be a wonderful alternative. If your VAT taxable turnover falls below the de-registration threshold of 83000 your business can ask HMRC to cancel its VAT registration.

Can I deregister for VAT. VAT deregistration is allowable at any time if your business falls below the deregistration threshold or if you expect taxable sales to fall below the threshold. If a business taxable turnover falls below the deregistration threshold currently 79000 per annum then it can deregister from VAT and no longer account for VAT on its sales.

This will benefit B2C businesses since your turnover threshold is reset to nil. Tax Consultant September 23 2017. Under VAT registration rules schedule 1 para 1 4 of Value Added Tax Act 1994 VATA 1994 specifies that when considering a persons taxable turnover to determine whether registration is required any turnover from a previous period of registration should normally be excluded.

However on the down side you have to account for VAT on a deemed supply of assets on hand at deregistration if the VAT comes to more than 1000. You must cancel within 30 days if you stop being eligible or you may be charged a penalty. You can ask HM Revenue and Customs HMRC to cancel your registration if your VAT.

You can cancel your registration online or fill in postal form VAT7 and send it to HMRC using the address on the form. When you cancel your registration you may have to account for VAT on any. If you do wish to deregister for VAT either temporarily or permanently your business turnover will need to be below the deregistration limit currently 80000 per annum.

The procedure that must be followed in order to deregister from VAT is to submit a completed VAT123 form at the SARS branch office where the vendor is registered. Once logged in click on the View your VAT Details link under the Making Tax Digital for VAT section.

How To Deregister For Vat Some Benefits And Disadvantages

How To Deregister For Vat Some Benefits And Disadvantages

Deregistration Tips Tax Adviser

Deregistration Tips Tax Adviser

Vat Services Birmingham Rr Accountants Accounting Bookkeeping Birmingham

Vat Services Birmingham Rr Accountants Accounting Bookkeeping Birmingham

Deregistering For Vat Caseron Cloud Accounting

Deregistering For Vat Caseron Cloud Accounting

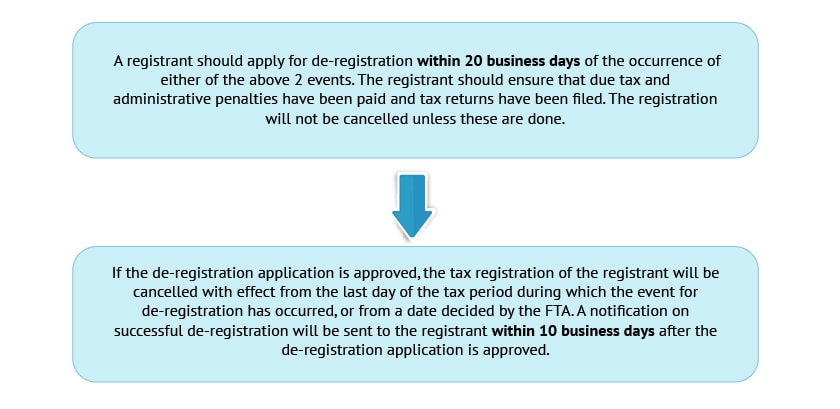

Guide On Deregistering Or Cancelling Vat Registration In Uae Vat Deregistration Penalty

Guide On Deregistering Or Cancelling Vat Registration In Uae Vat Deregistration Penalty

Vat Return Filing Period For 2020 In Uae Audit Services Transparency In Business Indirect Tax

Vat Return Filing Period For 2020 In Uae Audit Services Transparency In Business Indirect Tax

Voluntary Vat Deregistration Advantages Disadvantages Helpdeskdirect Consultancy Service

Voluntary Vat Deregistration Advantages Disadvantages Helpdeskdirect Consultancy Service

Vat Consultancy Services By Cda Bookkeeping Services Accounting Firms Accounting Services

Vat Consultancy Services By Cda Bookkeeping Services Accounting Firms Accounting Services

Why Should You Choose A Certified Tax Agent Uae Vat In Uae Vat In Uae Uae Tax

Why Should You Choose A Certified Tax Agent Uae Vat In Uae Vat In Uae Uae Tax

Deregistering For Vat How Do I Go About It

Deregistering For Vat How Do I Go About It

Lfs Vat Moss Attempting To Enrol

Lfs Vat Moss Attempting To Enrol

What Is Vat Deregistration And When Should A Company Apply For It Sdac Consulting

What Is Vat Deregistration And When Should A Company Apply For It Sdac Consulting

Companies And Individuals Who Registered With The Federal Tax Authority Fta For The Value Added Tax Can Der Money Concepts Family Money Saving Finance Saving

Companies And Individuals Who Registered With The Federal Tax Authority Fta For The Value Added Tax Can Der Money Concepts Family Money Saving Finance Saving

What Is Tin Tax Identification Number In Uae Audit Services Tax Informative

What Is Tin Tax Identification Number In Uae Audit Services Tax Informative

Reach Us For Vat Consultants In Dubai Aaccounting Llc Dubai Accounting Consulting

Reach Us For Vat Consultants In Dubai Aaccounting Llc Dubai Accounting Consulting

5 Steps For Vat Registration Process Gccfilings Trade Finance Marketing Budget Business Finance

5 Steps For Vat Registration Process Gccfilings Trade Finance Marketing Budget Business Finance

Finding Vat Consultants For Vat Deregistration In Uae Vat Cancellation Uae Financial Services Financial Uae

Finding Vat Consultants For Vat Deregistration In Uae Vat Cancellation Uae Financial Services Financial Uae

How To Deregister Under Vat Uae Vat

How To Deregister Under Vat Uae Vat