How To Fill In A W8 Form Uk

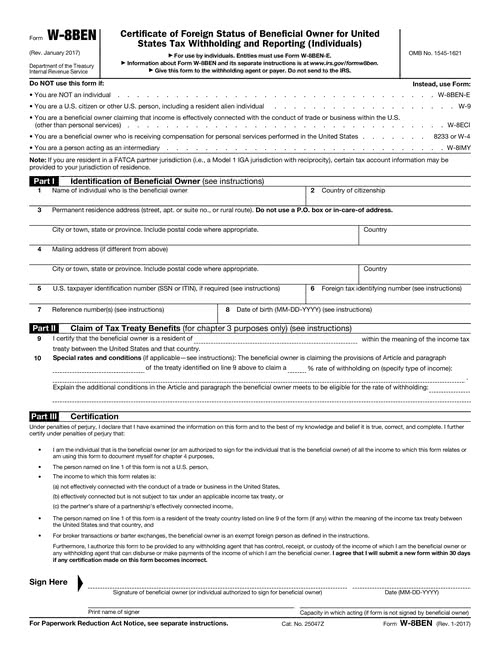

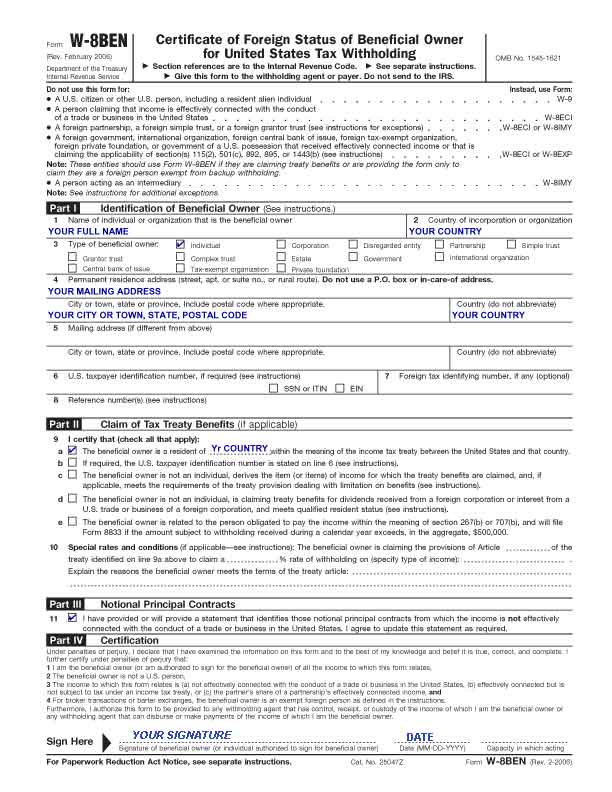

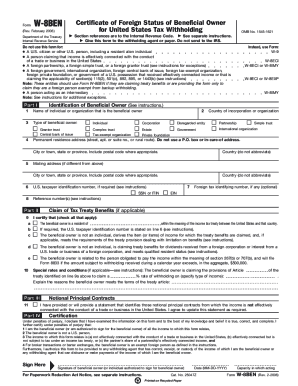

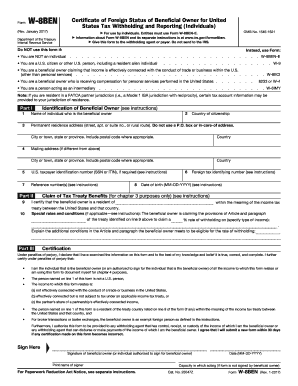

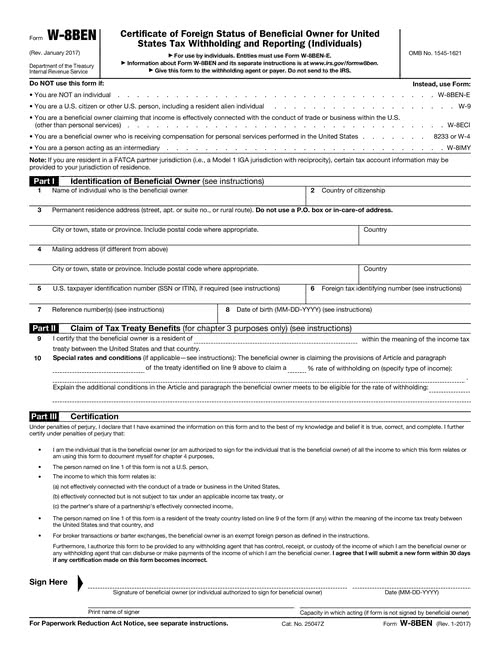

Review the situations listed at the top of the Form under the header Do NOT use this form if If any of these situations apply to you please use the form indicated instead of Form W-8BEN-E. Make them reusable by generating templates include and complete fillable fields.

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Check the active NFFE box on the right column of the list NFFE standing for Non-Financial Foreign Entity.

How to fill in a w8 form uk. Simplified Instructions for Completing a Form W-8BEN-E 3 Step 1. Read the entire form thoroughly before answering any questions. The way to complete the W8 form online.

Identification of Beneficial Owner. Individuals and sole proprietors need to file the W-8BEN form. The easiest way to do that is to look at the IRS website at URL.

Latest Version of the W 8 BEN E form Revision 2017. The Form W-8BEN-E should only be completed by a non-US. 99 of the companies we help fall into this category.

It is a United States legal tax form from the IRS Internal Revenue Service which is also. Simply complete it in line with the. Iam based in the UK UK citizen my limited company is registered in the UK and I pay all my Limited companys and Personal taxes in the UK.

Normally Non-US entities such as private Canadian companies with no US presence who make money with esta. Confirm that you are not precluded from using Form W-8BEN-E. The below step by step guide is to fill out that latest version of the form.

Expiration of Form W-8BEN. I have been associated with this client for over a year now but suddenly this month they are asking me to submit a W8 form. Fill in section 4 chapter 3 status hopefully ticking Corporation.

To get started on the blank use the Fill Sign Online button or tick the preview image of the document. Corporations and partnerships cannot use this form if they are incorporated formed or otherwise organized in the US. Estates cannot use this form if the decedent was a US.

A properly completed Form W-8BEN to treat a payment associated with the Form W-8BEN as a payment to a foreign person who beneficially owns the amounts paid. Enhance your efficiency with effective solution. Generally a Form W-8BEN will remain in effect for purposes of establishing foreign status for a period starting on the date the form is signed and ending on the last day of the third succeeding calendar year unless a change in circumstances makes any information on the form.

The W-8BEN-E is an IRS form used by foreign companies doing business in the United States. Not every section will apply to youskip it if it doesnt. Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US.

If youre a legal citizen of the United States at no point will you have to worry about filling out the form. If applicable the withholding agent may rely on the Form W-8BEN to apply a reduced rate of or exemption from withholding at source. You need to submit the latest version of the form.

Fill in sections 1 name of organisation and 2 country of incorporation. You can verify the version of the form on the top of the form. My client then makes the payment to my companys UK bank account every month.

Ensure that you fulfill all the requirements and are completing the correct form. Approve forms with a legal digital signature and share them by using email fax or print them out. Learn how to fill out W-8BEN form without errors.

If you are not a UK resident andor the form is for an account that is not held by you individually you will need to download a W-8BEN form from our website. Only corporations and partnerships need to file this form. Save blanks on your PC or mobile device.

Or by foreign business entities who make income in the US. Ignore section 3 name of disregarded entity. Check the corporation box.

Page 1 Part I. Enter your official contact and identification details. Now we can start filling in the W-8BEN-E.

Please take care when you are completing your Form W8-BEN as we are unable to accept any forms that have had amendments made to them. In this tutorial you will learn How to Complete the W-8BEN Form. Completing this form also means you can benefit from treaty relief on dividend and interest payments if you live in a country that has a relevant treaty with the US.

The advanced tools of the editor will lead you through the editable PDF template. Fill out forms electronically working with PDF or Word format. You can see it on the top of the form.

Only fill out the form in black or blue ink. Make sure you understand each question thoroughly and are providing the correct answer. Please note country abbreviations such as UK or GB will not be accepted If the W-8BEN Form is completed and signed by a duly authorised Power of Attorney for the beneficial owner or account holder the form must be accompanied by the Power of Attorney in proper form A W-8BEN Form will remain valid for purposes of.

The W-8BEN-E form is used to confirm that a vendor is a foreign company and must be filled out before the vendor can be paid according to the University of Washington. Provide Form W-8BEN to the withholding agent or. Fill in 1 companys name and 2 HQs country Fill in 3.

For Foreign Authors Wishing To Publish On Amazon Read This Self Publishing Review

For Foreign Authors Wishing To Publish On Amazon Read This Self Publishing Review

What W8 Form For A Uk Charity Fill Online Printable Fillable Blank Pdffiller

What W8 Form For A Uk Charity Fill Online Printable Fillable Blank Pdffiller

W8 Form Fill Out And Sign Printable Pdf Template Signnow

W8 Form Fill Out And Sign Printable Pdf Template Signnow

Us Withholding Tax Lucian Poll S Web Ramblings

Us Withholding Tax Lucian Poll S Web Ramblings

W 8ben Form Made Easy How To Complete The W 8ben Form Youtube

W 8ben Form Made Easy How To Complete The W 8ben Form Youtube

How To Fill In A W8ben Form If You Re In The Uk And Trading In The Usa

How To Fill In A W8ben Form If You Re In The Uk And Trading In The Usa

How To Fill Out W 8ben Form 2017 Updated Instructions Youtube

How To Fill Out W 8ben Form 2017 Updated Instructions Youtube

What Is A W 8 Form The Dough Roller

What Is A W 8 Form The Dough Roller

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

How To Fill Latest W 8ben E Form Rev 2017 Guide Updated 2019

How To Fill Latest W 8ben E Form Rev 2017 Guide Updated 2019

Irs W 8ben Form Template Fill Download Online Free Pdf

Irs W 8ben Form Template Fill Download Online Free Pdf

How To Fill W8ben E Form As A Company 2018 Youtube

How To Fill W8ben E Form As A Company 2018 Youtube

How To Complete W 8ben Form Youtube

How To Complete W 8ben Form Youtube

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

![]() How To Complete A W 8 Ben E Form Caseron Cloud Accounting

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

/W-8BEN-f742fd00d28643d9b8bffe36547ab6c7.png)