How Do I Claim Back Business Mileage

Keep records of the dates and mileage or your work journeys. My new business hasnt got any funds to reimburse mileage expenses.

Travel Expense Reimbursement Form Template Awesome 13 Free Mileage Reimbursement Form Template In 2020 Mileage Reimbursement Templates Business Travel

Travel Expense Reimbursement Form Template Awesome 13 Free Mileage Reimbursement Form Template In 2020 Mileage Reimbursement Templates Business Travel

It sounds a bit like robbing Peter to pay Paul but the.

How do i claim back business mileage. Using your own vehicle for work. Subtract the received MAP from the approved amount you should have received. Use the rates for the year youre claiming.

Add up the Mileage Allowance Payments you have received throughout the year. If you and your employees drive back and forth for business purposes its a business-related expense. This will include expenses like.

Add up your business mileage for the whole year. Increase your annual mileage according to the applicable AMAP rate. Thus employees can claim their petrol money back and the firm can deduct these reimbursements from its taxable income.

How much can I claim. You will usually receive 20 - 40 of the final amount back as a rebate depending on the rate of tax you pay. If youre one of the types of employees listed above youll also be able to claim mileage on your individual tax return at the rate of 0575 in 2020.

How much could my refund be. Take away any amount your employer pays you towards your costs sometimes called a mileage allowance. If you are using your own vehicle for work and are being reimbursed less than 045p per mile by your employer you could be claiming business mileage tax back on the distance you have travelled.

Lets say you drove 15000 miles for business in 2021. Youll report your miles and also answer a few questions about the vehicle on Form 2106. Keep a record of your business mileage.

But the IRS only lets you deduct business mileage on your taxes. You can use kilometre rates to work out allowable expenses for business of a vehicle. This rate includes driving costs gas repairsmaintenance and depreciation.

If your claim is over 2500 you must file a self-assessment tax return. You cannot claim tax relief if your employer either gives you. Or if you dont file a self-assessment tax return use a P87 form.

Add up the mileage for each vehicle type youve used for work. You may get around this if you have a qualifying home office deduction. This will give you the amount on which you can claim tax relief amount not the rebate.

Employees must follow the same rules that business owners and other self-employed workers follow. Mileage Allowance Relief can be calculated by multiplying your business mileage by the Approved Rates set out below. If you usually do not need to complete a tax return you can use form P87 on HMRCs website to claim MAR.

Trips to the bank and post office also qualify as business mileage if documented. On your self-assessment tax return. Add up all your motor expenses for the year and work out the business percentage based on the proportion of business miles you do.

Your commute is not tax deductible. Wait until the business has generated the necessary income and then claim. All the money back an alternative for example your employer gives you a laptop but you want a different type or model.

If youre making a reimbursement payment to someone the current rate applies until we provide the new rate. Multiply 15000 by the mileage deduction rate of 56 cents 15000 X 056. On your self-assessment tax return.

This is how I would do it in five simple steps. To find out your business tax deduction amount multiply your business miles driven by the IRS mileage deduction rate. Yes your mileage to work sites and back are business miles that must be supported by written documentation of where you went and how many business miles you traveled.

Deduct your employers mileage allowance if any. Introduce your own working capital into your business and then you can pay yourself back. Find out how much you can claim.

You could claim 8400 for the year using the standard mileage rate method. For amounts less than 2500 file your claim. Multiply your business miles driven by the standard rate 575 cents in 2020.

If youve never claimed before dont worry we can actually backdate it to 2015. Dont forget to keep a close track of your mileage including the purpose of each trip. Fill out the form below to find out.

For amounts under 2500 file your claim.

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Mileage Claim Form 10 Stereotypes About Mileage Claim Form That Aren T Always True Teaching Schools Student Resume Template Student Resume

Mileage Claim Form 10 Stereotypes About Mileage Claim Form That Aren T Always True Teaching Schools Student Resume Template Student Resume

Mileage Log Template For Self Employed Impressive Blank Mileage Form Log Forms Of 38 Luxury M Mileage Log Printable Mileage Monthly Budget Template

Mileage Log Template For Self Employed Impressive Blank Mileage Form Log Forms Of 38 Luxury M Mileage Log Printable Mileage Monthly Budget Template

Certified Management Accountant Cpa Maryland Bethesda Accountant Mileage Deduction Business Tax Deductions Accounting Training

Certified Management Accountant Cpa Maryland Bethesda Accountant Mileage Deduction Business Tax Deductions Accounting Training

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Mileage Claim Form Malaysia Five Moments That Basically Sum Up Your Mileage Claim Form Malay Word Template Letter Template Word Words

Mileage Claim Form Malaysia Five Moments That Basically Sum Up Your Mileage Claim Form Malay Word Template Letter Template Word Words

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

How To Make The Most Of Business Mileage Deductions Due

How To Make The Most Of Business Mileage Deductions Due

How To Record Mileage Help Center

How To Record Mileage Help Center

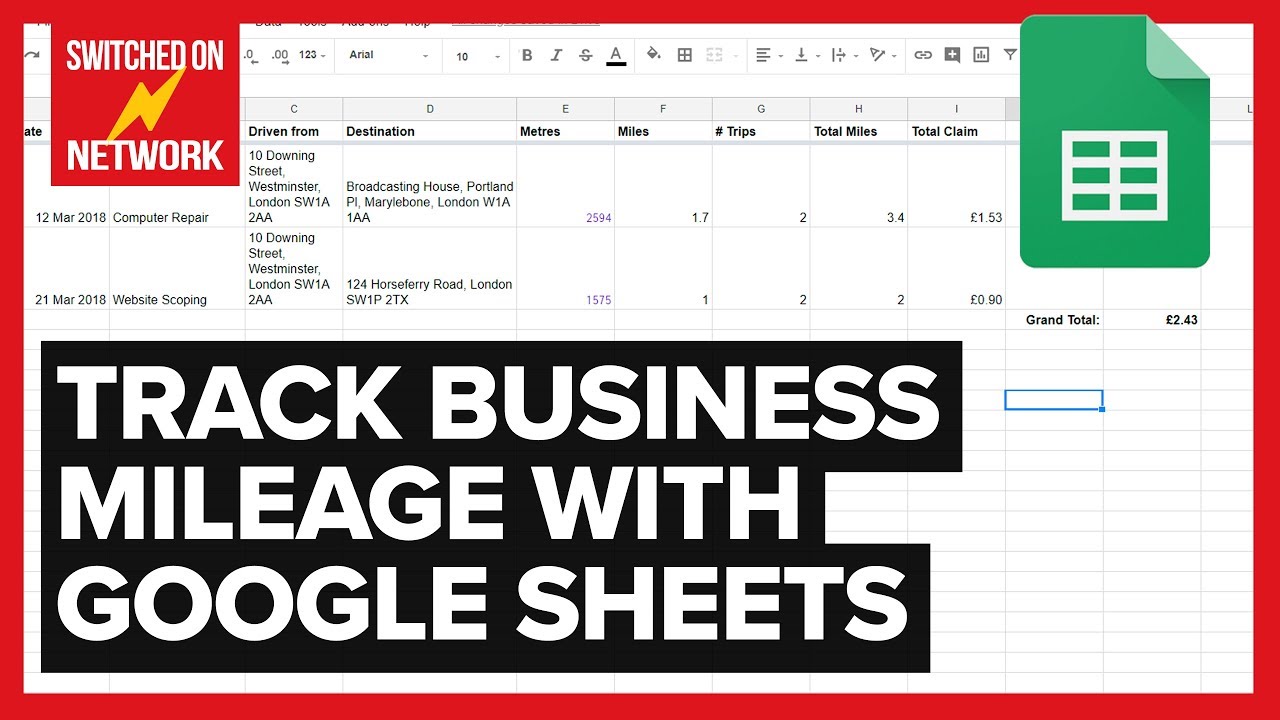

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

Get Your Free Small Business Tax Organizer For 2018 Income Tax Prep Organizer Includes Tax Tips Small Business Tax Business Tax Small Business Tax Deductions

Get Your Free Small Business Tax Organizer For 2018 Income Tax Prep Organizer Includes Tax Tips Small Business Tax Business Tax Small Business Tax Deductions

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Simple Expense Reimbursement Form Form Resume Examples Throughout Reimbursement Form Template Word Best Templates Business Template Spreadsheet Template

Simple Expense Reimbursement Form Form Resume Examples Throughout Reimbursement Form Template Word Best Templates Business Template Spreadsheet Template

Vehicle Mileage Log Form Mileage Tracker Mileage Log Printable Mileage

Vehicle Mileage Log Form Mileage Tracker Mileage Log Printable Mileage

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

How To Claim Business Mileage Why It S Ok For The Business

How To Claim Business Mileage Why It S Ok For The Business

Expenses Stock Photo Which Shows A Standard Uk Expense Form Not Yet Filled Out Tax Debt Tax Debt Relief Business Mileage

Expenses Stock Photo Which Shows A Standard Uk Expense Form Not Yet Filled Out Tax Debt Tax Debt Relief Business Mileage

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

Medical Mileage Expense Form Mileage Expensive Medical

Medical Mileage Expense Form Mileage Expensive Medical