Do Partners Receive 1099

Thus any payment for services of 600 or more to a lawyer or law firm must be the subject of a Form 1099 and it does not matter if the law firm is a corporation LLC LLP or general partnership nor does it matter how large or small the law firm may be. Partnerships or Multimember LLCs as they essentially file the same return as a partnership.

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Good Morning My business partner and I are the founders and owners of the company.

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Do partners receive 1099. Generally if you receive a Form 1099 for amounts that actually belong to another person or entity you are considered a nominee recipient. But not an LLC thats treated as an S-Corporation or C-Corporation. Heres another way to remember.

If you also receive other personal freelance income outside of the partnership you may have both 1099 income and K-1 income to report on your Form 1040. Sole Proprietorships and Partnerships. This will eliminate the IRS looking for the money on the wrong tax return.

IRS Form 1099-MISC Mandates. If the partnership provides services to other companies the partnership may receive 1099 forms to include as part of their IRS Form 1065. So LLCs can and will receive 1099s when they are either a single-member LLC or taxed as a partnership.

A pship should not issue a 1099-MISC to a partner. However there are some instances in which you dont need to issue a 1099-MISC. It would have been helpful if you had said which type of 1099 it is.

They are sent to you from an employer that paid you for a service 1099 or business entity that will then distribute it out to shareholders or business partners K1. The information that you see on the form is what you use to fill out your individual tax return to be filed. Sole proprietor Do send 1099-MISC.

I am attempting to serve it to you less boring and more concise manner. If an LLC operates as a sole proprietorship it has to file a 1099 with specific information required by the IRS. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs.

A pship can issue a 1099-INT to a partner if that partner loans the pship funds in his capacity as a lender not a partner and the pship pays interest on that loan. You must file a Form 1099 with the IRS the same type of Form 1099. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

To keep it simple both of these are types of information returns. We have been drawing money as our salary every month without being on payroll and receive form 1099 at the end of. Proprietors social security number which may act as a tax identification number.

The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600. If however a partnership decides to treat certain partners as employees for payroll tax purposes there is a risk that not all of the partners allocable share of partnership income will be reported on Form W-2 because the partnership tax return will not be completed until months after the Form W-2 must be filed with the IRS and the. An LLC will not receive a 1099 if taxed as an s-corporation.

According to the IRS all businesses must send non-corporate service providers Form 1099-MISC for payments exceeding 600 in. Who are considered Vendors or Sub-Contractors. Required information includes the following.

You can nominee the Forms 1099-MISC to the partnership from yourselves by using the instructions below. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. Suppliers of merchandise telegrams telephone freight storage and similar items with the exception of those who deal in fish or other aquatic life.

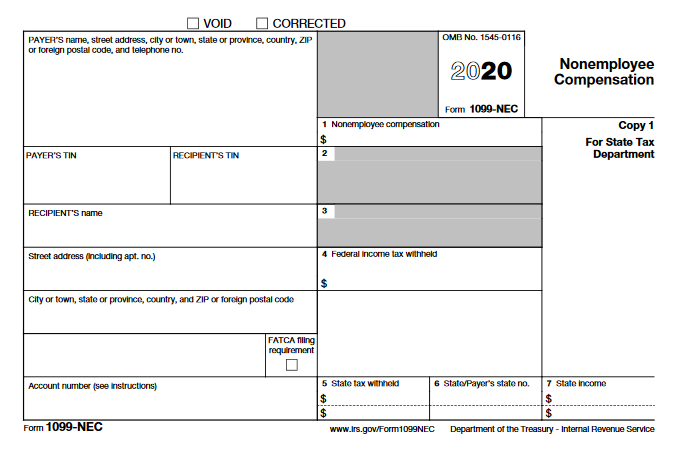

Freelancers Meet The New Form 1099 Nec

Freelancers Meet The New Form 1099 Nec

Pin By Beyond Just Numbers On Moonstonepros Taxes Employer Identification Number Business Tax Tax Checklist

Pin By Beyond Just Numbers On Moonstonepros Taxes Employer Identification Number Business Tax Tax Checklist

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint