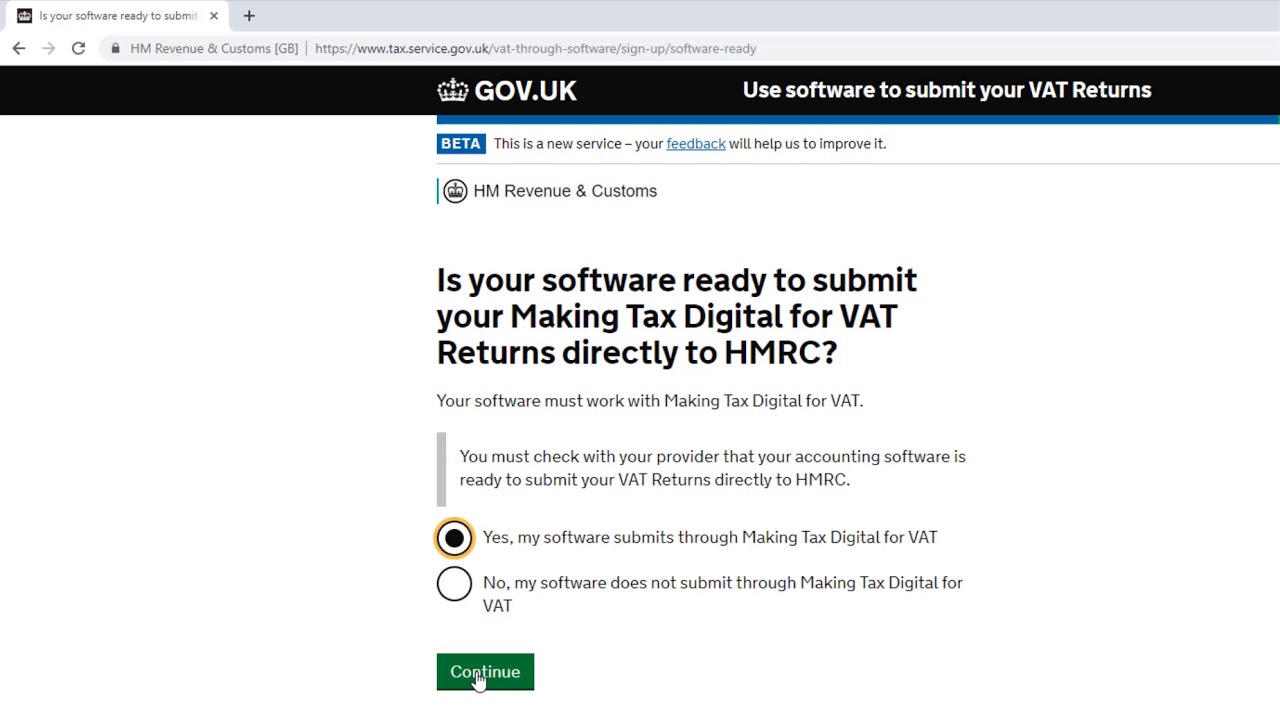

Sign Up For Mtd For Vat With Hmrc

You can choose to sign up to Making Tax Digital for VAT if your business earns less than 85000. The Government Gateway ID youre using to connect Xero to HMRC is the same ID you used to sign up to MTD for VAT.

How To Do An Online Vat Return With Hmrc Quickbooks Uk

How To Do An Online Vat Return With Hmrc Quickbooks Uk

Check the VAT number in financial settings is correct.

Sign up for mtd for vat with hmrc. It promises to revol. In order to file VAT through the MTD experience please ensure you follow the above steps. Have your Government Gateway login details ready.

Has it been longer than 72 hours. To open a GOVUK website and request an authorisation code choose Process then Request Authorisation Code and then choose Continue. HMRC sends an email confirming the account is on the new service within 72 hours.

HMRC MTD VAT authorisation You need to activate the HMRC MTD VAT account at our system to complete the grant authorisation process. After youve signed youll receive a confirmation email from noreplytaxservice within 72 hours. Having been suffering from a VAT blockage Ive just de-registered for electronic VAT submission in QB and gone through the whole process with the HMRC online MTD sign up.

Sign in with your HMRC credentials. Select Manage HMRC connections in the HMRC connections section. Sign up for MTD for VAT.

Grant authority to interact with HMRC on your behalf. You must sign up for Making Tax Digital for VAT if your taxable turnover is more than 85000 so you can. Are you saying that I will not be able to connect to HMRC until the return is due.

Please note that only users with full level 8 access will be able to see the HMRC connections section. In the Accounting menu select Reports. After signing up for MTD for VAT with HMRC log in to your FreeAgent account and select Connections from the drop-down menu at the top right of the screen.

Any VAT registered businesses who are not already signed up to MTD HMRC will gradually migrate onto their new ETMP platform in stages during 2021 in advance of MTD for VAT. To sign up for MTD please follow the below steps. Sign up to MTD for VAT via the HMRC website by clicking here.

Make sure you have your Government Gateway user login details and information about your business such as your VAT number to hand as you will be asked to provide these to sign up. If you use alternative VAT workflows it will not show the MTD. Dont forget to check your spam folder.

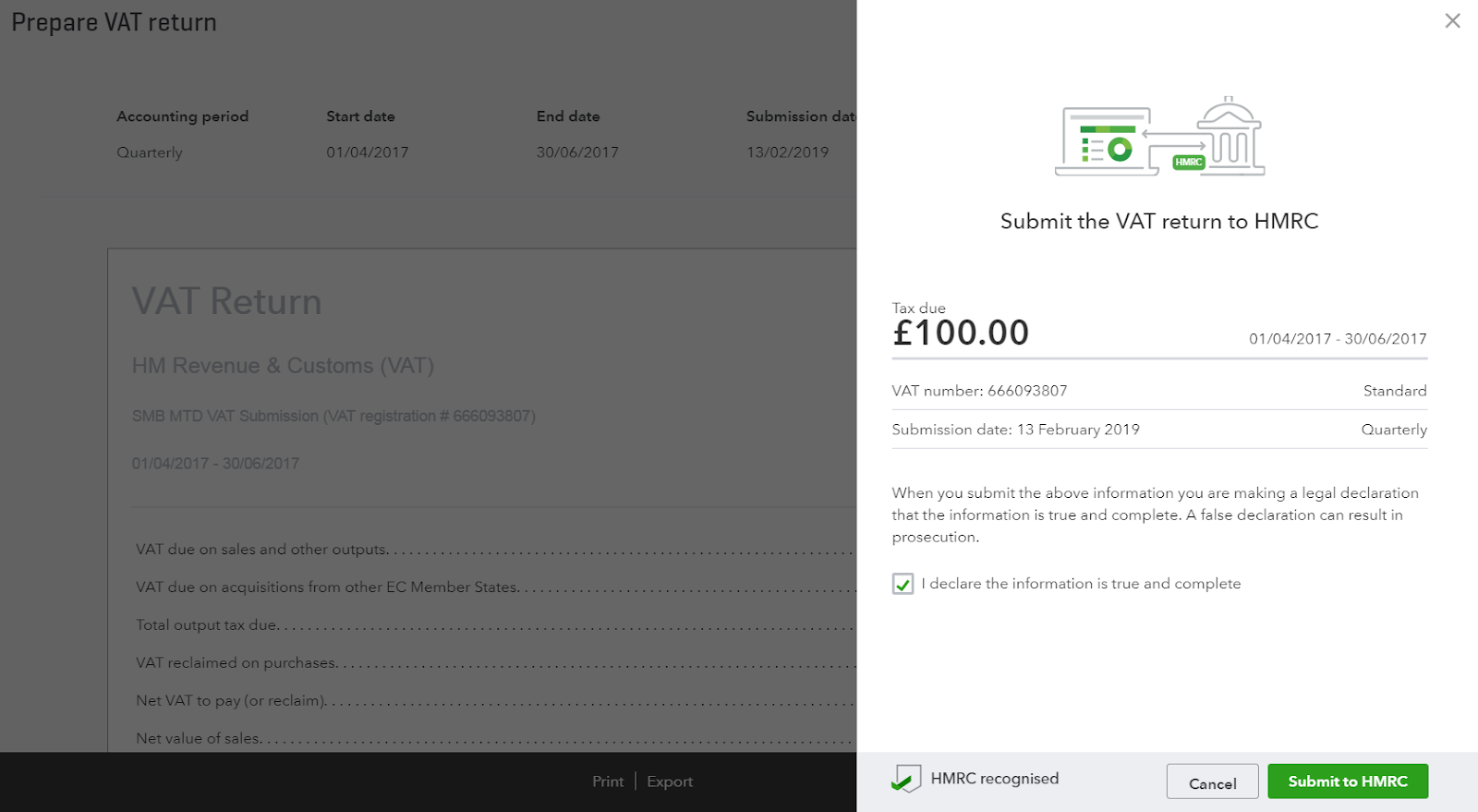

If youre a small business also check. Review your return and click File Return. QB did show that I was signed up for MTD but just couldnt log on like many others on here.

Check your e-mail for an account activation mail with a link from us and activate your account. An agent services account this is different to your HMRC online services for. The first step you need to take is to sign up for MTD on the HMRC website.

From 1 April 2022 all VAT registered businesses must sign up whatever they earn. Submit your businesss VAT return using compatible software. Before you sign up your client youll need.

This lets the government know that you intend to submit your next VAT return in an MTD compliant way. Check the ID by signing in to your Business Tax Account in HMRC. To allow the Dynamics 365 Business Central MTD VAT application to interact with HMRC.

Sign up for MTD for VAT with HMRC and wait for confirmation by email that youve been moved to the MTD service. HMRC should restore the connection within 72 hours. Check if you need to follow HMRCs rules for Making Tax Digital for VAT find software and sign up.

Voluntary filers have the option to sign up to MTD and submit their VAT this way although if they do they must also keep digital records as part of the wider MTD for VAT requirements. Under Tax click VAT Return. The account is signed up for MTD for VAT with HMRC.

Next VAT return is due end of March 21. Sign into HMRC using your goverment gateway credentials. But sign up wasnt mandatory at the time as it was for those above the VAT threshold.

Click the relevant VAT return and click Proceed. Agree to the declaration and click File Return. Compatible software to submit their VAT Return.

Connect Xero to HMRC. Signed up for a Making Tax Digital account with HMRC submitted a VAT return to HMRC If so hold tight. Watch this video to learn How to sign up for Making Tax Digital MTD for VAT ReturnsHMRCs new mandate comes into effect 1 April 2019.

Stay Ahead Of Upcoming Changes To Uk Vat Submissions Xu Hub

Stay Ahead Of Upcoming Changes To Uk Vat Submissions Xu Hub

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Submit A Vat Return In A Making Tax Digital Mtd Compliant Way In Quickbooks Youtube

Submit A Vat Return In A Making Tax Digital Mtd Compliant Way In Quickbooks Youtube

Uniform Tax Rebate Form P87 Download Tax Rebates Tax Refund Tax

Uniform Tax Rebate Form P87 Download Tax Rebates Tax Refund Tax

Brexit Commodity Codes Tariffs And Vat Calculations

Brexit Commodity Codes Tariffs And Vat Calculations

How To Set Up Vat Online Read Tutorial Quickbooks Uk

How To Set Up Vat Online Read Tutorial Quickbooks Uk

Vat Return Services Bookkeeping Peterborough Business

Vat Return Services Bookkeeping Peterborough Business

Hmrc Mtd For Vat Sign Up Process Youtube

Hmrc Mtd For Vat Sign Up Process Youtube

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Vat Automation Software Probovat Hmrc Approved

Vat Automation Software Probovat Hmrc Approved

Submit A Vat Return To Hmrc Mtd For Small Busine

Submit A Vat Return To Hmrc Mtd For Small Busine

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Mtd Vat Tax Entry Not Picking Vat Registration Number Sage X3 General Discussion Sage X3 Sage City Community

Mtd Vat Tax Entry Not Picking Vat Registration Number Sage X3 General Discussion Sage X3 Sage City Community

Does Mtd For Vat Makes Business Life Easier Homeowners Insurance Property Tax Make Business

Does Mtd For Vat Makes Business Life Easier Homeowners Insurance Property Tax Make Business

Apply For A Repayment Of Tax Using R40 Tax Form Tax Forms Savings And Investment Tax Free

Apply For A Repayment Of Tax Using R40 Tax Form Tax Forms Savings And Investment Tax Free

What Is Making Tax Digital Mtd Freshbooks

What Is Making Tax Digital Mtd Freshbooks

Vitaltax Making Tax Digital Mtd For Vat

Vitaltax Making Tax Digital Mtd For Vat

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs