Does A Catering Company Get A 1099

Non-resident alien person for IRS purpos es is any foreign entity eg foreign individual foreign company etc. Additionally businesses will need to file Form 1099-NEC.

Bristol Farms Weekly Ad Http Www Myweeklyads Net Bristol Farms Bristol Farms Catering Menu Bulk Food

Bristol Farms Weekly Ad Http Www Myweeklyads Net Bristol Farms Bristol Farms Catering Menu Bulk Food

You should still send a 1099-MISC to a single-member limited liability company or a one-person limited corporation Ltd but not an LLC that has elected S corporation or C corporation status.

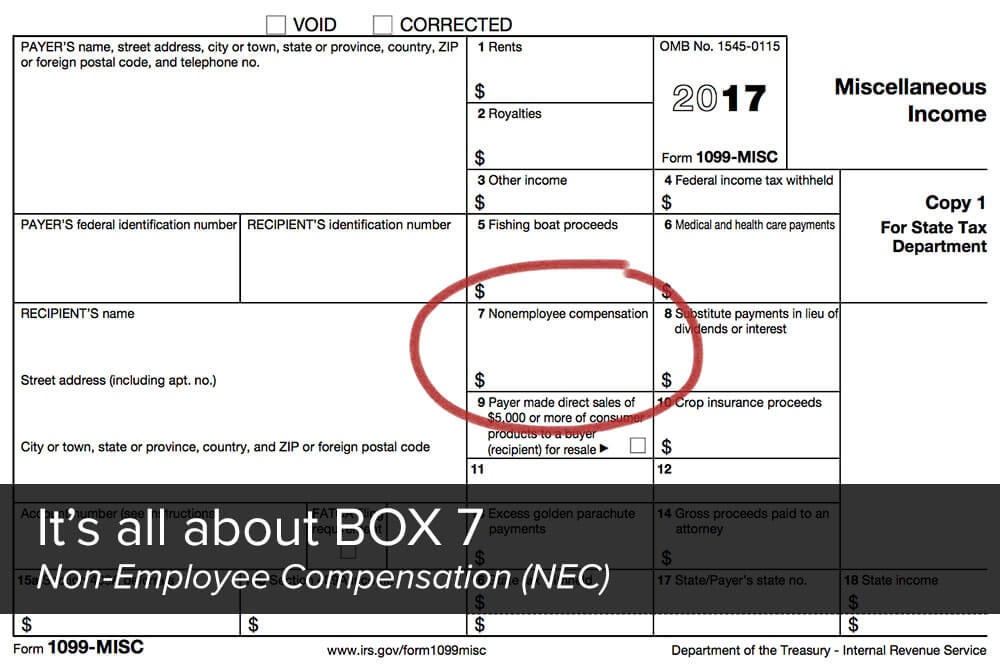

Does a catering company get a 1099. If you received a Form 1099-MISC to report your income from your catering gig you are considered self-employed in the eyes of the IRS and your income and expenses must be reported on Schedule C. 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. The payment is made for services in the course of your trade or business.

The payment is made to an individual partnership estate or corporation. This rule includes both C corporations and S corporations. Person including a US.

If you pay an independent contractor more than 600 in the year and their business entity is not an S corp or a C corp then you must file Form 1099-NEC. A good catering company will be transparent with their costs and explain to the clients why they made the decisions they did for example hiring X number of servers or choosing one wine over another. It should show all Forms 1099 issued under your Social Security number.

Day of event Before guests arrive the catering supervisor team will work hard to set up the tables chairs bars and begin preparing food. You only have to file a Form 1099 if someone performs services as the first expert said. See the TurboTax articles below for more guidance.

If the company caters four quarterly parties and bills you 150 for each you still have to send the owner a 1099 form. The payment total is at least 600 for the year. File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically.

If you are purchasing the food from the catering company and they are not serving it this is not a service so you wouldnt send them a 1099. If you pay that much money to your ad agency or the printer making your fliers the company gets a 1099-MISC. The cutoff for sending a 1099 for services rendered is 600.

The Substitute Form W-9 is NOT valid if completed by a non-resident alien person. That doesnt have to be a single 600 party. Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099.

Vendors who operate as C- or S-Corporations do not require a 1099. The total for the year is. You need to file 1099 forms and have paid 1099 vendors.

When you purchase something and it is delivered and that is where the service ends there is NO 1099 requirement as. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. It doesnt matter if the room charge is separately stated on the bill to the customer or included in the charge for catering.

Which means exempt from 1099 reporting and 3 They are a US. When a business pays an independent contractor for services performed in the course of that business the service recipient must file Form 1099 MISC if the payment is 600 or more for the year unless the service provider is a Corporation. You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent.

The exception to this rule is if you paid via credit card or a third party payment platform like Paypal. You are running your own business to provide your catering services even if it was only one time. Therefore there is NOT a Form 1099 filing requirement.

Beginning with tax year 2011 the IRS requires you to exclude certain payment types you made to a 1099 vendor on Form 1099-MISC that will be included on third party payment processors such as credit card companies PayPal etc. When the catering service is sold by a hotel or a caterer hired by the hotel the charge for rental of the room is part of the charge for the event and is taxable. The exception to this rule is with paying attorneys.

You are not required to send a 1099-MISC form to a corporation. In most circumstances 1099-MISC are filed only when a company pays an individual or a partnership. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

Direct Sales The law requires information reporting on Form 1099 MISC for certain direct sellers. Companies usually arent required to issue 1099s to corporate entities such as PLLCs that provide professional services to them just as theyre not required to file 1099-MISC forms for corporations. Report the total you paid in box.

Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each person in the course of your business to whom you have. If the company provided a service including parts and materials to your business that is 600 or more then you are required to send them a 1099 unless they are incorporated. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not.

When they pay an. You will need to provide a 1099 to any vendor who is a.

1099 Tax Magic Use Tax Free Dollars To Hire The Expert Help You Need Wealth Factory

1099 Tax Magic Use Tax Free Dollars To Hire The Expert Help You Need Wealth Factory

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

Design 26 By Chai O Create A Flyer For An Asian Fusion Catering Company Catering Asian Fusion Catering Design

Design 26 By Chai O Create A Flyer For An Asian Fusion Catering Company Catering Asian Fusion Catering Design

1099 Form Fillable What Is A 1099 Form And How Do I File E What Is A 1099 Business Letter Template Job Application Form

1099 Form Fillable What Is A 1099 Form And How Do I File E What Is A 1099 Business Letter Template Job Application Form

1099 Form Fillable All Categories Bioseven Fillable Forms 1099 Tax Form Doctors Note Template

1099 Form Fillable All Categories Bioseven Fillable Forms 1099 Tax Form Doctors Note Template

Who Should Receive A 1099 Misc Form Affordable Bookkeeping Payroll Payroll Form Bookkeeping

Who Should Receive A 1099 Misc Form Affordable Bookkeeping Payroll Payroll Form Bookkeeping

Form 1096 Sample Templates Invoice Template Word Template

Form 1096 Sample Templates Invoice Template Word Template

Customer Feedback Form Templates 13 Free Xlsx Docs Pdf Samples Feedback Customer Feedback Survey Template

Customer Feedback Form Templates 13 Free Xlsx Docs Pdf Samples Feedback Customer Feedback Survey Template

The 1099 Decoded The What Who Why How 1099s Small Business Accounting Business Management Degree Small Business Finance

The 1099 Decoded The What Who Why How 1099s Small Business Accounting Business Management Degree Small Business Finance

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

How To File Taxes For Food Delivery And Rideshare Drivers Rideshare Driver Filing Taxes Rideshare

How To File Taxes For Food Delivery And Rideshare Drivers Rideshare Driver Filing Taxes Rideshare

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

New Year Special Offer Food Menu Food Food Poster

New Year Special Offer Food Menu Food Food Poster

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Prospect Sheet Customer Call Follow Up Call Sheet Catering Intended For Customer Contact Report Template 10 P Sales Report Template How To Plan Sales Skills

Prospect Sheet Customer Call Follow Up Call Sheet Catering Intended For Customer Contact Report Template 10 P Sales Report Template How To Plan Sales Skills

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions