How To Give Someone A 1099 Form

At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. In addition to giving independent contractors 1099-Misc forms you need to give a 1099-Misc for services rent of office space or.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Form 1099-NEC Nonemployee Compensation is transmitted with Form 1096 Annual Summary and Transmittal of US.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

How to give someone a 1099 form. If the business was established newly and doesnt have an idea about Printable 1099-Misc Forms then IRS provides a one-month extension to file the Form 1099-Misc. The term 1099 refers to the type of tax form that a person with this working relationship receives from the various companies that hire him or her. File Form 1099-MISC for each person to whom you have paid during the year.

Information Returns which is similar to a cover letter for your Forms 1099-NEC. However the payor has until April 1 2018 to report your winnings to the IRS. If you had income under 600 from that payer you wont receive a 1099-NEC form but you still must include the income amount on your tax return.

You can also buy 1099-MISC forms at your local office supply store although most only come in batches of 25 or 50. The independent contractor and company negotiate a rate for work and services which is often part of short-term projects. You can download and print the form you need Copy B of 1099-MISC from the IRS website.

The separate instructions for filersissuers for Form 1099-NEC are available in the 2020 Instructions for Forms 1099-MISC and 1099-NEC. You have to either order them from the IRS or pick them up at an. The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments.

You can ask the IRS to send you the necessary form by calling 1-800-TAX-FORM 1-800-829-3676 or navigating to their online ordering page. At least 600 in. Step 2 - Grab Your Forms.

Next you must submit your 1099-MISCs to the IRS. Cash gifts can be subject to tax rates that range from 18 percent to 40 percent depending on the size. The 1099-Misc is only used for business purposes.

1099-Misc Miscellaneous Income other than box 7 income is mailed to the taxpayer by January 31 2018. Write the amount paid to that contractor over the course of the year in Box 7 labeled Nonemployee Compensation. While these can be sent electronically recipients have to first agree to receive them electronically so it may be easier to send these by mail especially if youre getting down to the wire.

The tax is paid by the person or entity providing the gift but most people avoid the gift tax. Use the form whether you have a business for profit or run a nonprofit organization. Write your business name business tax ID number the contractors name and contractors tax ID number--likely her Social Security number--on the 1099 Form.

If your business decides to give 600 to a client for no reason were not sure why you wont need to distribute a 1099 form. Step 3 - Fill Out the Forms. Before the 2020 tax year Free Fillable 1099-Misc Form Box 7 is used for reporting non-employee payments.

The IRS phone number. Make sure you have the current name address and social security numbers on file for. There are however some gifts that will need to be reported and taxed.

Obtain a 1099-MISC form from the IRS or another reputable source. Step 1 - Check Your Information. Form W-2G Certain Gambling Winnings is mailed to the taxpayer by January 31 2018.

The best way to determine this is to request a form W-9. You dont need to issue 1099s for payment made for personal purposes. Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was 600 or more.

A business does not need a 1099 if it is a C corporation. How To 1099 Someone. The IRS will also send you a Form 4852 PDF Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc along with a letter.

After February 14 the IRS will contact the employerpayer for you and request the missing form. LLCs typically need a 1099-Misc unless it is taxed as an S corp or C corp. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS.

The 1099-NEC form has replaced what used to be recorded on Form 1099-MISC Box 7. You cannot download these. This will give you the business information needed to prepare the 1099-Misc and also indicate how the LLC is.

You will complete and send a 1099-NEC form to any independent contractors or businesses to whom you paid over 600 in fees commissions prizes awards or other forms of compensation for services performed for your business. It should show all Forms 1099 issued under your Social Security number.

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

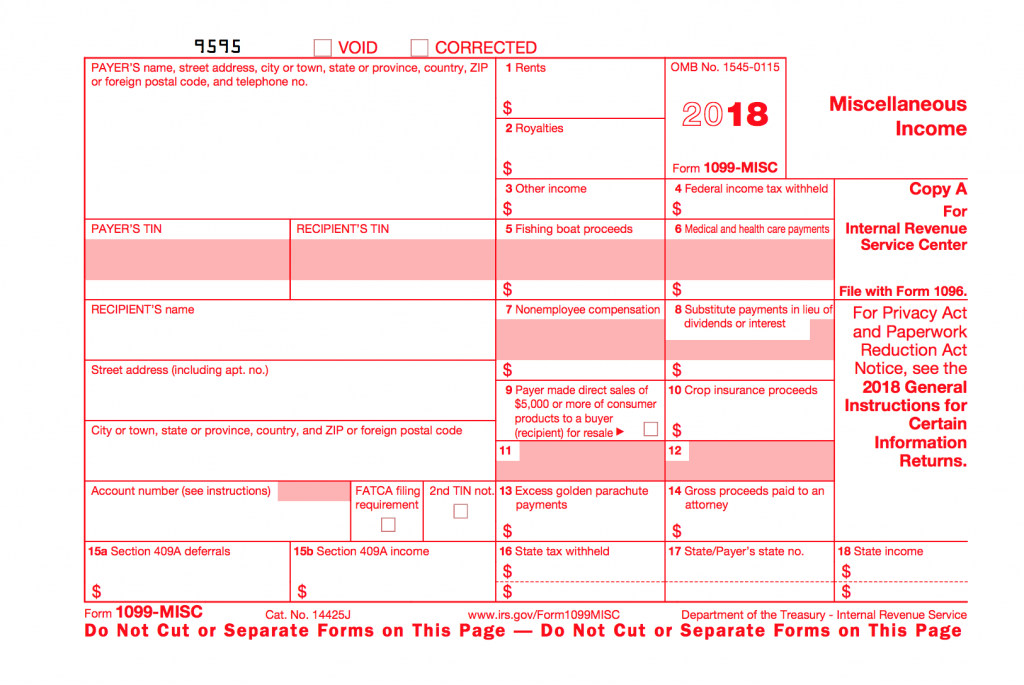

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager